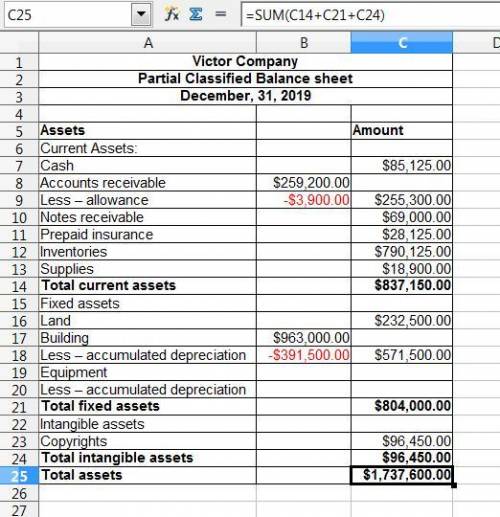

Presented below is information related to victor company at december 31, 2019. assume a tax rate of 30% on all items. account title amount account title amtaccounts payable $ 204,975 income taxes payable 78,000accounts receivable 259,200 interest payable 2,850accum. depreciation - building - 391,500 inventory 790,125additional paid-in capital 81,900 land 232,500allowance for doubtful accounts 3,900 notes payable-short-term 96,000notes receivable due in 6 months. 69,000bonds payable (due 2025) 600,000 preferred stock 375,000buildings 963,000 prepaid insurance 28,125cash 85,125 salaries and wages payable 17,100common stock 562,500 supplies 18,900copyrights 96,450 trading securities 36,300debt investments (long-term) 140,700 retained earnings 306,000requirements: prepare the asset section of a classified balance sheet for victor company using the report form. include all headings, subheading, subtotals, and totals (with labels) that appear on a classified balance sheet.

Answers: 2

Another question on Business

Business, 21.06.2019 15:00

He cornerstone of arsoac, the is organized into four like battalions and provides nighttime, all-weather, medium range insertion, extraction, and resupply capability in hostile or denied areas.

Answers: 2

Business, 21.06.2019 15:00

Pursuant to the video, if the news reporter had challenged the reasonableness of her detention by the coach store, coach could have claimed the which is also known as merchant protection statutes according to the book.

Answers: 2

Business, 21.06.2019 21:30

Peninsula products has just applied for a loan at your bank. when reviewing peninsula's books for the year that just ended, you notice that the firm uses the fair value option for its bonds payable. you also see that the firm recorded a $55,000 debit in its bonds payable account and a $55,000 credit in its unrealized holding gain or loss"income account. over that same period, interest rates decreased by about 0.5 percent. how should this information affect the bank's decision as to whether to grant peninsula a loan? a : the bank should strongly consider giving a loan to peninsula because the changes in firm's bonds payable and unrealized holding gain or loss"income accounts suggest that peninsula has seen an increase in its credit rating over the past year. b : the bank should put little emphasis on the changes in peninsula's bonds payable and unrealized holding gain or loss"income accounts because these changes are likely the result of the rise in interest rates. c : the bank should hesitate before giving a loan to peninsula because the changes in firm's bonds payable and unrealized holding gain or loss"income accounts suggest that peninsula has seen a decline in its credit rating over the past year. d : the bank should put little emphasis on the changes in peninsula's bonds payable and unrealized holding gain or loss"income accounts because these changes are likely unrelated to either interest rates or the firm's credit rating.

Answers: 2

Business, 21.06.2019 23:50

Juan has a retail business selling skateboard supplies he maintains large stockpiles of every item he sells in a warehouse on the outskirts of town he keeps finding that he has to reorder certain supplies all the time but others only once a year how can he solve this problem?

Answers: 1

You know the right answer?

Presented below is information related to victor company at december 31, 2019. assume a tax rate of...

Questions

English, 29.12.2020 21:40

Mathematics, 29.12.2020 21:40

Mathematics, 29.12.2020 21:40

Mathematics, 29.12.2020 21:50

Physics, 29.12.2020 21:50

Mathematics, 29.12.2020 21:50

Mathematics, 29.12.2020 21:50

Mathematics, 29.12.2020 21:50

Advanced Placement (AP), 29.12.2020 21:50