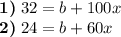

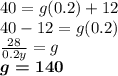

Acertain movie star's salary for each film she makes consists of a fixed amount, along with a percentage of the gross revenue the film generates. in her last two roles, the star made $32 million on a film that grossed $100 million, and $24 million on a film that grossed $60 million. if the star wants to make at least $40 million on her next film, what is the minimum amount of gross revenue the film must generate? answer in terms of $ millions.

Answers: 3

Another question on Business

Business, 21.06.2019 18:20

When someone buys a fourth television for his or her house, what is the result? a. there's a decrease in the marginal utility of the television. b. the increase in demand brings leads to higher prices for televisions. c. the production of televisions becomes more efficient. d. there's a rise in the opportunity cost of buying other goods.

Answers: 2

Business, 22.06.2019 03:00

Afirm's before-tax cost of debt, rd, is the interest rate that the firm must pay on debt. because interest is tax deductible, the relevant cost of debt used to calculate a firm's wacc is the cost of debt, rd (1 – t). the cost of debt is used in calculating the wacc because we are interested in maximizing the value of the firm's stock, and the stock price depends on cash flows. it is important to emphasize that the cost of debt is the interest rate on debt, not debt because our primary concern with the cost of capital is its use in capital budgeting decisions. the rate at which the firm has borrowed in the past is because we need to know the cost of capital. for these reasons, the on outstanding debt (which reflects current market conditions) is a better measure of the cost of debt than the . the on the company's -term debt is generally used to calculate the cost of debt because more often than not, the capital is being raised to fund -term projects. quantitative problem: 5 years ago, barton industries issued 25-year noncallable, semiannual bonds with a $1,600 face value and a 8% coupon, semiannual payment ($64 payment every 6 months). the bonds currently sell for $845.87. if the firm's marginal tax rate is 40%, what is the firm's after-tax cost of debt? round your answer to 2 decimal places. do not round intermediate calcu

Answers: 3

Business, 22.06.2019 05:00

What is a sort of auction for stocks in which traders verbally submit their offers?

Answers: 3

Business, 22.06.2019 19:30

Anew firm is developing its business plan. it will require $615,000 of assets, and it projects $450,000 of sales and $355,000 of operating costs for the first year. management is reasonably sure of these numbers because of contracts with its customers and suppliers. it can borrow at a rate of 7.5%, but the bank requires it to have a tie of at least 4.0, and if the tie falls below this level the bank will call in the loan and the firm will go bankrupt. what is the maximum debt ratio the firm can use? (hint: find the maximum dollars of interest, then the debt that produces that interest, and then the related debt ratio.)a. 41.94%b. 44.15%c. 46.47%d. 48.92%e. 51.49%

Answers: 3

You know the right answer?

Acertain movie star's salary for each film she makes consists of a fixed amount, along with a percen...

Questions

History, 06.10.2020 15:01

English, 06.10.2020 15:01

History, 06.10.2020 15:01

Mathematics, 06.10.2020 15:01

Mathematics, 06.10.2020 15:01

Spanish, 06.10.2020 15:01

History, 06.10.2020 15:01

Mathematics, 06.10.2020 15:01

Spanish, 06.10.2020 15:01

Mathematics, 06.10.2020 15:01

Mathematics, 06.10.2020 15:01

Mathematics, 06.10.2020 15:01

Chemistry, 06.10.2020 15:01

History, 06.10.2020 15:01

Physics, 06.10.2020 15:01

is equal to a fixed basic remuneration

is equal to a fixed basic remuneration  plus a percentage

plus a percentage  of the gross income

of the gross income  , that is:

, that is:

millions salary:

millions salary:

millions

millions