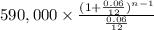

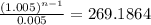

Winston enterprises would like to buy some additional land and build a new factory. the anticipated total cost is $158.82 million. the owner of the firm is quite conservative and will only do this when the company has sufficient funds to pay cash for the entire expansion project. management has decided to save $590,000 a month for this purpose. the firm earns 6 percent compounded monthly on the funds it saves. how long does the company have to wait before expanding its operations? (do not round intermediate calculations.)

Answers: 3

Another question on Business

Business, 21.06.2019 21:50

Franklin painting company is considering whether to purchase a new spray paint machine that costs $4,800. the machine is expected to save labor, increasing net income by $720 per year. the effective life of the machine is 15 years according to the manufacturer’s estimate. required determine the unadjusted rate of return based on the average cost of the investment.

Answers: 2

Business, 22.06.2019 19:30

Consider the following two projects. both have costs of $5,000 in year 1. project 1 provides benefits of $2,000 in each of the first four years only. the second provides benefits of $2,000 for each of years 6 to 10 only. compute the net benefits using a discount rate of 6 percent. repeat using a discount rate of 12 percent. what can you conclude from this exercise?

Answers: 3

Business, 22.06.2019 20:10

Quick computing currently sells 12 million computer chips each year at a price of $19 per chip. it is about to introduce a new chip, and it forecasts annual sales of 22 million of these improved chips at a price of $24 each. however, demand for the old chip will decrease, and sales of the old chip are expected to fall to 6 million per year. the old chips cost $10 each to manufacture, and the new ones will cost $14 each. what is the proper cash flow to use to evaluate the present value of the introduction of the new chip? (enter your answer in millions.)

Answers: 1

Business, 22.06.2019 21:00

Warner inc. sells a high-speed retrieval system for mining information. it provides the following information for the year. budgeted actual overhead cost $965,700 $905,000 machine hours 58,570 49,200 direct labor hours 107,300 104,200 overhead is applied on the basis of direct labor hours. compute the predetermined overhead rate. predetermined overhead rate $ per direct labor hour link to text determine the amount of overhead applied for the year. the amount of overhead applied $

Answers: 1

You know the right answer?

Winston enterprises would like to buy some additional land and build a new factory. the anticipated...

Questions

Arts, 01.09.2021 22:30

Mathematics, 01.09.2021 22:30

Chemistry, 01.09.2021 22:30

Mathematics, 01.09.2021 22:30

Mathematics, 01.09.2021 22:30

Mathematics, 01.09.2021 22:30

Biology, 01.09.2021 22:30