Business, 23.09.2019 19:00 shellxavier1

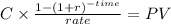

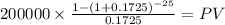

You are offered an annuity that will pay you $200,000 once per year, at the end of the year, for 25 years. the first payment will arrive one year from now. the last payment will arrive twenty-five years from now. suppose your annual discount rate is i=17.25%, how much are you willing to pay for this annuity? (hint: this is the same as the present value of an annuity.) 11. an investment gives you a 18.35% nominal return over 1 year. there was 2.5% inflation over that year. what was your exact real return? (don’t use the fisher equation.)

Answers: 2

Another question on Business

Business, 22.06.2019 06:30

73. calculate the weighted average cost of capital (wacc) based on the following information: the equity multiplier is 1.66; the interest rate on debt is 13%; the required return to equity holders is 22%; and the tax rate is 35%. (a) 15.6% (b) 16.0% (c) 15.0% (d) 16.6% (e) none of the above

Answers: 2

Business, 22.06.2019 12:50

Jallouk corporation has two different bonds currently outstanding. bond m has a face value of $50,000 and matures in 20 years. the bond makes no payments for the first six years, then pays $2,100 every six months over the subsequent eight years, and finally pays $2,400 every six months over the last six years. bond n also has a face value of $50,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. the required return on both these bonds is 10 percent compounded semiannually. what is the current price of bond m and bond n?

Answers: 3

Business, 22.06.2019 16:00

If the family’s net monthly income is 7,800 what percent of the income is spent on food clothing and housing?

Answers: 3

Business, 23.06.2019 02:20

Required information lansing company’s 2017 income statement and selected balance sheet data (for current assets and current liabilities) at december 31, 2016 and 2017, follow. lansing company income statement for year ended december 31, 2017 sales revenue $130,200 expenses cost of goods sold 53,000 depreciation expense 17,500 salaries expense 29,000 rent expense 10,100 insurance expense 4,900 interest expense 4,700 utilities expense 3,900 net income $7,100 lansing company selected balance sheet accounts at december 31 2017 2016 accounts receivable $6,700 $8,000 inventory 3,080 2,090 accounts payable 5,500 6,800 salaries payable 1,100 810 utilities payable 440 270 prepaid insurance 370 500 prepaid rent 440 290 required: prepare the cash flows from operating activities section only of the company’s 2017 statement of cash flows using the indirect method. (amounts to be deducted should be indicated with a minus sign.)

Answers: 1

You know the right answer?

You are offered an annuity that will pay you $200,000 once per year, at the end of the year, for 25...

Questions

Mathematics, 31.08.2021 22:50

Mathematics, 31.08.2021 22:50

Mathematics, 31.08.2021 22:50

Mathematics, 31.08.2021 22:50

History, 31.08.2021 22:50

Mathematics, 31.08.2021 22:50

Mathematics, 31.08.2021 22:50

English, 31.08.2021 22:50

Biology, 31.08.2021 22:50

Spanish, 31.08.2021 22:50