Business, 24.09.2019 03:00 kitttimothy55

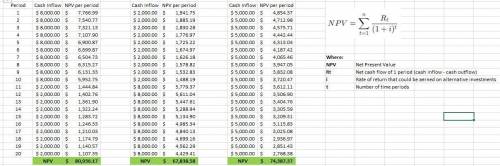

Assume that potential projects x, y and z will each pay a total of $100,000 over 20 years. x pays $8,000 per year for 10 years and $2,000 per year for 10 years. y pays $2,000 per year for 10 years and $8,000 per year for 10 years. z pays $5,000 per year for 20 years. which project is likely to be most attractive to an investor?

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 1

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

Business, 22.06.2019 15:00

Which of the following is least likely to a team solve problems together

Answers: 1

Business, 22.06.2019 22:40

Johnson company uses the allowance method to account for uncollectible accounts receivable. bad debt expense is established as a percentage of credit sales. for 2018, net credit sales totaled $6,400,000, and the estimated bad debt percentage is 1.40%. the allowance for uncollectible accounts had a credit balance of $61,000 at the beginning of 2018 and $49,500, after adjusting entries, at the end of 2018.required: 1. what is bad debt expense for 2018 as a percent of net credit sales? 2. assume johnson makes no other adjustment of bad debt expense during 2018. determine the amount of accounts receivable written off during 2018.3. if the company uses the direct write-off method, what would bad debt expense be for 2018?

Answers: 1

You know the right answer?

Assume that potential projects x, y and z will each pay a total of $100,000 over 20 years. x pays $8...

Questions

Social Studies, 04.04.2021 15:50

Physics, 04.04.2021 15:50

English, 04.04.2021 15:50

English, 04.04.2021 15:50

Social Studies, 04.04.2021 15:50

Mathematics, 04.04.2021 15:50

Mathematics, 04.04.2021 15:50

Mathematics, 04.04.2021 15:50

Chemistry, 04.04.2021 15:50

Mathematics, 04.04.2021 15:50

Social Studies, 04.04.2021 15:50

Social Studies, 04.04.2021 15:50

English, 04.04.2021 15:50

Social Studies, 04.04.2021 15:50

Mathematics, 04.04.2021 15:50

Biology, 04.04.2021 15:50