Business, 24.09.2019 05:00 robbylynnbonner

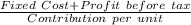

Hunter & sons sells a single model of meat smoker for use in the home. the smokers have the following price and cost characteristics. sales price $ 79 per smoker variable costs 40 per smoker fixed costs 308,100 per month hunter & sons is subject to an income tax rate of 40 percent. required: a. how many smokers must hunter & sons sell every month to break even? b. how many smokers must hunter & sons sell to earn a monthly operating profit of $51,480 after taxes?

Answers: 2

Another question on Business

Business, 22.06.2019 06:30

73. calculate the weighted average cost of capital (wacc) based on the following information: the equity multiplier is 1.66; the interest rate on debt is 13%; the required return to equity holders is 22%; and the tax rate is 35%. (a) 15.6% (b) 16.0% (c) 15.0% (d) 16.6% (e) none of the above

Answers: 2

Business, 22.06.2019 20:00

Assume the perpetual inventory method is used. 1) the company purchased $12,500 of merchandise on account under terms 2/10, n/30. 2) the company returned $1,200 of merchandise to the supplier before payment was made. 3) the liability was paid within the discount period. 4) all of the merchandise purchased was sold for $18,800 cash. what effect will the return of merchandise to the supplier have on the accounting equation?

Answers: 2

Business, 23.06.2019 15:00

Ultravision inc. anticipates sales of $280,000 from january through april. materials will represent 50 percent of sales, and because of level production, material purchases will be equal for each month during the four months of january, february, march, and april. materials are paid for one month after the month purchased. materials purchased in december of last year were $24,000 (half of $48,000 in sales). labor costs for each of the four months are slightly different due to a provision in the labor contract in which bonuses are paid in february and april. the labor figures are: january $14,000 february 17,000 march 14,000 april 19,000 fixed overhead is $10,000 per month. prepare a schedule of cash payments for january through april. (assume the $280,000 of sales occur equally over the four months of january through april, i.e. monthly sales = $280,000 / 4.)

Answers: 3

Business, 24.06.2019 00:30

Janice is a baby boomer, born in 1959. between the ages of 18 and 50, she held only five jobs. according to a study published by the bureau of labor statistics in 2015, janice's experience is below the job average for people born from 1957 to 1964, who held an average of jobs between the ages of 18 and 48.

Answers: 1

You know the right answer?

Hunter & sons sells a single model of meat smoker for use in the home. the smokers have the fol...

Questions

Health, 13.07.2019 15:30

Computers and Technology, 13.07.2019 15:30

Health, 13.07.2019 15:30

Mathematics, 13.07.2019 15:30

Health, 13.07.2019 15:30

Mathematics, 13.07.2019 15:40

Mathematics, 13.07.2019 15:40

Mathematics, 13.07.2019 15:40

Mathematics, 13.07.2019 15:40

Biology, 13.07.2019 15:40

English, 13.07.2019 15:40

English, 13.07.2019 15:40

= $85,800

= $85,800

= 10,100

= 10,100