Adriana company is highly automated and uses computers to control manufacturing operations. the company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of computer-hours. the following estimates were used in preparing the predetermined overhead rate at the beginning of the year:

computer-hours 82,000

fixed manufacturing overhead cost $ 1,278,000

variable manufacturing overhead per computer-hour $ 3.40

during the year, a severe economic recession resulted in cutting back production and a buildup of inventory in the company�s warehouse. the company�s cost records revealed the following actual cost and operating data for the year:

computer-hours 60,000

manufacturing overhead cost $ 1,208,000

inventories at year-end:

raw materials $ 420,000

work in process $ 120,000

finished goods $ 1,030,000

cost of goods sold $ 2,770,000

required:

1.

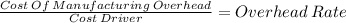

compute the company�s predetermined overhead rate for the year. (round your answer to two decimal places.)

predetermined overhead rate $ per hour

2.

compute the underapplied or overapplied overhead for the year. (input the amount as a positive value. round your predetermined overhead rate calculation to two decimal places. round your final answer to the nearest dollar amount.)

(click to select)overappliedunderapplied overhead cost $

3.1

assume the company closes any underapplied or overapplied overhead directly to cost of goods sold. prepare the appropriate journal entry. (round your predetermined overhead rate calculation to two decimal places. round your final answer to the nearest dollar amount.)

general journal debit credit

(click to select)salaries expensedepreciation expensemanufacturing overheadfinished goodscost of goods soldwork in processraw materialsaccounts payable

(click to select)depreciation expensework in processsalaries expensefinished goodsaccounts payableraw materialsmanufacturing overheadcost of goods sold

3.2

will this entry increase or decrease net operating income?

this entry will increase net operating income.

this entry will decrease net operating income.

Answers: 1

Another question on Business

Business, 21.06.2019 17:10

At the beginning of the accounting period, nutrition incorporated estimated that total fixed overhead cost would be $50,600 and that sales volume would be 10,000 units. at the end of the accounting period actual fixed overhead was $56,100 and actual sales volume was 11,000 units. nutrition uses a predetermined overhead rate and a cost plus pricing model to establish its sales price. based on this information the overhead spending variance is multiple choice $5,500 favorable. $440 favorable. $5,500 unfavorable. $440 unfavorable.

Answers: 3

Business, 22.06.2019 01:30

In the fall, jay thompson decided to live in a university dormitory. he signed a dorm contract under which he was obligated to pay the room rent for the full college year. one clause stated that if he moved out during the year, he could sell his dorm contract to another student who would move into the dormitory as his replacement. the dorm cost was $5000 for the two semesters, which jay had already paid a month after he moved into the dorm, he decided he would prefer to live in an apartment. that week, after some searching for a replacement to fulfill his dorm contract, jay had two offers. one student offered to move in immediately and to pay jay $300 per month for the eight remaining months of the school year. a second student offered to move in the second semester and pay $2500 to jay. jay estimates his food cost per month is $500 if he lives in the dorm and $450 if he lives in an apartment with three other students. his share of the apartment rent and utilities will be $404 per month. assume each semester is 4.5 months long. disregard the small differences in the timing of the disbursements or receipts. what is the cost of the cheapest alternative?

Answers: 1

Business, 22.06.2019 02:30

Required information [the following information applies to the questions displayed below.] the following data is provided for garcon company and pepper company. garcon company pepper company beginning finished goods inventory $ 13,800 $ 18,850 beginning work in process inventory 16,700 20,700 beginning raw materials inventory 8,800 13,500 rental cost on factory equipment 28,250 26,650 direct labor 22,400 37,400 ending finished goods inventory 17,300 14,300 ending work in process inventory 23,200 19,400 ending raw materials inventory 5,900 9,600 factory utilities 11,250 15,000 factory supplies used 10,900 5,700 general and administrative expenses 32,500 44,500 indirect labor 2,500 9,880 repairs—factory equipment 4,820 2,150 raw materials purchases 41,500 63,000 selling expenses 54,800 49,000 sales 238,530 317,510 cash 33,000 23,700 factory equipment, net 222,500 124,825 accounts receivable, net 13,400 23,950 required: 1. complete the table to find the cost of goods manufactured for both garcon company and pepper company for the year ended december 31, 2017. 2. complete the table to calculate the cost of goods sold for both garcon company and pepper company for the year ended december 31, 2017.

Answers: 2

Business, 22.06.2019 07:10

1. the healthy pantry bought new shelving and financed $7,300 with 36 monthly payments of $267.65 each. suppose the firm pays the loan off with 13 payments left. use the rule of 78 to find the amount of unearned interest. 2. the healthy pantry bought new shelving and financed $7,300 with 36 monthly payments of $267.65 each. suppose the firm pays the loan off with 13 payments left. use the rule of 78 to find the amount necessary to pay off the loan. ! i entered 967.82 for question 1 and 5,455.78 for question 2 and it said it was

Answers: 3

You know the right answer?

Adriana company is highly automated and uses computers to control manufacturing operations. the comp...

Questions

Mathematics, 12.05.2021 06:40

Mathematics, 12.05.2021 06:40

Mathematics, 12.05.2021 06:40

Mathematics, 12.05.2021 06:40

Mathematics, 12.05.2021 06:40

Advanced Placement (AP), 12.05.2021 06:40

Mathematics, 12.05.2021 06:40

Social Studies, 12.05.2021 06:40

Mathematics, 12.05.2021 06:40

Arts, 12.05.2021 06:40