Business, 26.09.2019 23:00 ghari112345

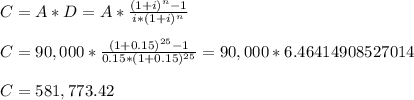

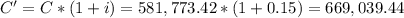

Gyou and your wife are making plans for retirement. you plan on living 25 years after you retire and would like to have $90,000 annually on which to live. your first withdrawal will be made one year after you retire and you anticipate that your retirement account will earn 15% annually. what amount do you need in your retirement account the day you retire? round your answer to the nearest cent. do not round intermediate calculations. $ assume that your first withdrawal will be made the day you retire. under this assumption, what amount do you now need in your retirement account the day you retire? round your answer to the nearest cent. do not round intermediate calculations.

Answers: 2

Another question on Business

Business, 21.06.2019 22:30

Your project team’s recommendations to increase productivity have been approved and your team is now working on an implementation plan. in order to accomplish the plan, several subject matter experts from various parts of the organization have been brought in to assist. you have noticed friction and conflict among team members. some of the disagreement and opposition on your team supports the achievement of team goals and objectives. this type of conflict can be described as:

Answers: 1

Business, 22.06.2019 01:30

At the end of the week, carla receives her paycheck and goes directly to the bank after work to make a deposit into her savings account. the bank keeps the required reserve and then loans out the remaining balance to a qualified borrower named malik as a portion of his small business loan. malik uses the loan to buy a tractor for his construction business and makes small monthly payments to the bank to payback the principal balance plus interest on the loan. the bank profits from a portion of the interest payment received and also passes some of the interest back to carla in the form of an interest payment to her savings account. in this example, the bank is acting

Answers: 1

Business, 22.06.2019 12:50

Explain whether each of the following events increases or decreases the money supply. a. the fed buys bonds in open-market operations. b. the fed reduces the reserve requirement. c. the fed increases the interest rate it pays on reserves. d. citibank repays a loan it had previously taken from the fed. e. after a rash of pickpocketing, people decide to hold less currency. f. fearful of bank runs, bankers decide to hold more excess reserves. g. the fomc increases its target for the federal funds rate.

Answers: 3

Business, 22.06.2019 19:00

Tri fecta, a partnership, had revenues of $369,000 in its first year of operations. the partnership has not collected on $45,000 of its sales and still owes $39,500 on $155,000 of merchandise it purchased. there was no inventory on hand at the end of the year. the partnership paid $27,000 in salaries. the partners invested $48,000 in the business and $23,000 was borrowed on a five-year note. the partnership paid $2,070 in interest that was the amount owed for the year and paid $9,500 for a two-year insurance policy on the first day of business. compute net income for the first year for tri fecta.

Answers: 2

You know the right answer?

Gyou and your wife are making plans for retirement. you plan on living 25 years after you retire and...

Questions

Mathematics, 02.06.2021 17:40

Business, 02.06.2021 17:40

Mathematics, 02.06.2021 17:40

Mathematics, 02.06.2021 17:40

Mathematics, 02.06.2021 17:40

Mathematics, 02.06.2021 17:40

Mathematics, 02.06.2021 17:40

Social Studies, 02.06.2021 17:40

Mathematics, 02.06.2021 17:40

Mathematics, 02.06.2021 17:40