Business, 26.09.2019 23:00 simeragrundy14

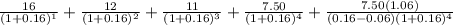

Lohn corporation is expected to pay the following dividends over the next four years: $16, $12, $11, and $7.50. afterwards, the company pledges to maintain a constant 6 percent growth rate in dividends forever. if the required return on the stock is 16 percent, what is the current share price?

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

technology is the application of knowledge and tools to solve problems and perform tasks more efficiently. t/f

Answers: 1

Business, 22.06.2019 06:00

Suppose that a monopolistically competitive restaurant is currently serving 260 meals per day (the output where mr

Answers: 2

Business, 22.06.2019 11:10

An insurance company estimates the probability of an earthquake in the next year to be 0.0015. the average damage done to a house by an earthquake it estimates to be $90,000. if the company offers earthquake insurance for $150, what is company`s expected value of the policy? hint: think, is it profitable for the insurance company or not? will they gain (positive expected value) or lose (negative expected value)? if the expected value is negative, remember to show "-" sign. no "+" sign needed for the positive expected value

Answers: 2

Business, 22.06.2019 21:00

Suppose either computers or televisions can be assembled with the following labor inputs: units produced 1 2 3 4 5 6 7 8 9 10 total labor used 3 7 12 18 25 33 42 54 70 90 (a) draw the production possibilities curve for an economy with 54 units of labor. label it p54. (b) what is the opportunity cost of the eighth computer? (c) suppose immigration brings in 36 more workers. redraw the production possibilities curve to reflect this added labor. label the new curve p90.

Answers: 2

You know the right answer?

Lohn corporation is expected to pay the following dividends over the next four years: $16, $12, $11...

Questions

Mathematics, 24.10.2020 02:00

Mathematics, 24.10.2020 02:00

English, 24.10.2020 02:00

Mathematics, 24.10.2020 02:00

Mathematics, 24.10.2020 02:00

Mathematics, 24.10.2020 02:00

Computers and Technology, 24.10.2020 02:00

Computers and Technology, 24.10.2020 02:00

Mathematics, 24.10.2020 02:00

Mathematics, 24.10.2020 02:00

Biology, 24.10.2020 02:00

Advanced Placement (AP), 24.10.2020 02:00

.

.

= $77.81

= $77.81