Business, 27.09.2019 00:00 davidsouth444

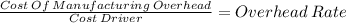

Hep me solve this you! tevebaugh corporation is a manufacturer that uses job-order costing. the company closes out any overapplied or underapplied overhead to cost of goods sold at the end of the year. the company has supplied the following data for the just completed year: beginning inventories: finished goods $ 30,000 estimated total manufacturing overhead at the beginning of the year $ 568,000 estimated direct labor-hours at the beginning of the year 32,000 direct labor-hoursresults of operations: raw materials (all direct) requisitioned for use in production $ 501,000 direct labor cost $ 683,000 actual direct labor-hours 33,000 direct labor-hoursmanufacturing overhead: indirect labor cost $ 176,000 other manufacturing overhead costs incurred $ 420,000 selling and administrative: selling and administrative salaries $ 219,000 other selling and administrative expenses $ 346,000 cost of goods manufactured $ 1,567,000 sales revenue $ 2,498,000 cost of goods sold (unadjusted) $ 1,376,000 the net operating income is: garrison 16e rechecks 2017-08-28multiple choice$892,750$765,750$546,750$1,11 1,750

Answers: 1

Another question on Business

Business, 21.06.2019 13:30

Sam robinson borrowed $21,000 from a friend and promised to pay the loan in 10 equal annual installments beginning one year from the date of the loan. sam’s friend would like to be reimbursed for the time value of money at a 9% annual rate. what is the annual payment sam must make to pay back his friend?

Answers: 1

Business, 22.06.2019 01:00

Granby foods' (gf) balance sheet shows a total of $25 million long-term debt with a coupon rate of 8.50%. the yield to maturity on this debt is 8.00%, and the debt has a total current market value of $27 million. the company has 10 million shares of stock, and the stock has a book value per share of $5.00. the current stock price is $20.00 per share, and stockholders' required rate of return, r s, is 12.25%. the company recently decided that its target capital structure should have 35% debt, with the balance being common equity. the tax rate is 40%. calculate waccs based on book, market, and target capital structures. what is the sum of these three waccs?

Answers: 3

Business, 22.06.2019 11:20

In 2000, campbell soup company launched an ad campaign that showed prepubescent boys offering soup to prepubescent girls. the girls declined because they were concerned about their calorie intake. the boys explained that “lots of campbell’s soups are low in calories,” which made them ok for the girls to eat. the ads were pulled after parents expressed concern. why were parents worried? i

Answers: 2

Business, 22.06.2019 17:30

Alinguist had a gross income of 53,350 last year. if 17.9% of his income got witheld for federal income tax, how much of the linguist's pay got witheld for federal income tax last year?

Answers: 2

You know the right answer?

Hep me solve this you! tevebaugh corporation is a manufacturer that uses job-order costing. the com...

Questions

Mathematics, 26.02.2021 15:10

Mathematics, 26.02.2021 15:10

Law, 26.02.2021 15:10

Mathematics, 26.02.2021 15:10

Biology, 26.02.2021 15:10

Mathematics, 26.02.2021 15:10

English, 26.02.2021 15:10

Mathematics, 26.02.2021 15:10

Mathematics, 26.02.2021 15:10

Mathematics, 26.02.2021 15:10