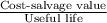

Computing depreciation, net book value, and gain or loss on asset sale lynch company owns and operates a delivery van that originally cost $46,400. lynch has recorded straight-line depreciation on the van for four years, calculated assuming a $5,000 expected salvage value at the end of its estimated six-year useful life. depreciation was last recorded at the end of the fourth year, at which time lynch disposes of this van. a. compute the net book value of the van on the disposal date. $ 0 b. compute the gain or loss on sale of the van if the disposal proceeds are: use a negative sign with your answer if the sale results in a loss. a cash amount equal to the van's net book value. $ 0 $22, 500 cash. $ 0 $18, 500 cash. $ 0

Answers: 3

Another question on Business

Business, 21.06.2019 20:30

Which of the following government agencies is responsible for managing the money supply in the united states? a. the u.s. mint b. the federal reserve bank c. congress d. the department of the treasury 2b2t

Answers: 3

Business, 22.06.2019 04:40

What is ur favorite song and by who i know dis is a random question

Answers: 2

Business, 22.06.2019 09:30

Oliver's company is planning the launch of their hybrid cars. the company has included "never-before-seen" product benefits in the hybrid cars. which type of advertising should oliver's company use for the new cars?

Answers: 1

Business, 22.06.2019 10:30

True or false: a fitted model with more predictors will necessarily have a lower training set error than a model with fewer predictors.

Answers: 2

You know the right answer?

Computing depreciation, net book value, and gain or loss on asset sale lynch company owns and operat...

Questions

Mathematics, 01.06.2020 20:57

Chemistry, 01.06.2020 20:57

History, 01.06.2020 20:57

Mathematics, 01.06.2020 20:57

Mathematics, 01.06.2020 20:57

Mathematics, 01.06.2020 20:57

Mathematics, 01.06.2020 20:57

Mathematics, 01.06.2020 20:57

Mathematics, 01.06.2020 20:57

English, 01.06.2020 20:57

Physics, 01.06.2020 20:57

History, 01.06.2020 20:57

Mathematics, 01.06.2020 20:57