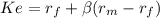

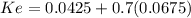

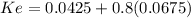

Company a has a beta of 0.70, while company b's beta is 0.80. the required return on the stock market is 11.00%, and the risk-free rate is 4.25%. what is the difference between a's and b's required rates of return? (hint: first find the market risk premium, then find the required returns on the stocks.)

Answers: 3

Another question on Business

Business, 22.06.2019 04:30

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Business, 22.06.2019 05:50

Match the steps for conducting an informational interview with the tasks in each step.

Answers: 1

Business, 22.06.2019 07:10

mark, a civil engineer, entered into a contract with david. as per the contract, mark agreed to design and build a house for david for a specified fee. mark provided david with an estimation of the total cost and the contract was mutually agreed upon. however, during construction, when mark increased the price due to a miscalculation on his part, david refused to pay the amount. this scenario is an example of a mistake.

Answers: 1

Business, 22.06.2019 09:00

Harry is 25 years old with a 1.55 rating factor for his auto insurance. if his annual base premium is $1,012, what is his total premium? $1,568.60 $2,530 $1,582.55 $1,842.25

Answers: 3

You know the right answer?

Company a has a beta of 0.70, while company b's beta is 0.80. the required return on the stock marke...

Questions

Mathematics, 12.07.2019 19:00

Social Studies, 12.07.2019 19:00

World Languages, 12.07.2019 19:00

Mathematics, 12.07.2019 19:00

English, 12.07.2019 19:00

Mathematics, 12.07.2019 19:00

Mathematics, 12.07.2019 19:00