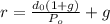

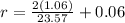

Columbus manufacturing's stock currently sells for $ 23.57 a share. the stock just paid a dividend of $2 a share (i. e.,d0=2). the dividend is expected to grow at a constant rate of 6 % a year. what is the required rate of return on the company's stock? express your answer in percentage, and round it to two decimal places, i. e., 13.54, for example for 0.1354)

Answers: 2

Another question on Business

Business, 21.06.2019 13:30

According to the map, which continent has the most countries with a low gdp level? which two countries have the highest gdp level?

Answers: 1

Business, 21.06.2019 20:30

If delta airlines were to significantly change its fare structure and flight schedule to enhance its competitive position in response to aggressive price cutting by southwest airlines, this would be an example ofanswers: explicit collusion.tacit collusion.competitive dynamics.a harvest strategy.

Answers: 3

Business, 22.06.2019 01:00

Bond x is noncallable and has 20 years to maturity, a 7% annual coupon, and a $1,000 par value. your required return on bond x is 10%; if you buy it, you plan to hold it for 5 years. you (and the market) have expectations that in 5 years, the yield to maturity on a 15-year bond with similar risk will be 9.5%. how much should you be willing to pay for bond x today? (hint: you will need to know how much the bond will be worth at the end of 5 years.) do not round intermediate calculations. round your answer to the nearest cent.

Answers: 3

Business, 22.06.2019 10:00

Suppose an economy has only two sectors: goods and services. each year, goods sells 80% of its outputs to services and keeps the rest, while services sells 62% of its output to goods and retains the rest. find equilibrium prices for the annual outputs of the goods and services sectors that make each sector's income match its expenditures.

Answers: 2

You know the right answer?

Columbus manufacturing's stock currently sells for $ 23.57 a share. the stock just paid a dividend o...

Questions

English, 19.01.2021 17:00

Mathematics, 19.01.2021 17:00

Mathematics, 19.01.2021 17:00

Mathematics, 19.01.2021 17:00

Mathematics, 19.01.2021 17:00

Biology, 19.01.2021 17:00

Mathematics, 19.01.2021 17:00

Geography, 19.01.2021 17:00

Mathematics, 19.01.2021 17:00