Business, 02.10.2019 00:20 madisonrendler1787

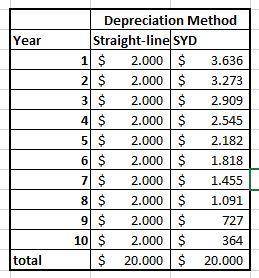

During 2016 and 2017, faulkner manufacturing used the sum-of-the-years’-digits (syd) method of depreciation for its depreciable assets, for both financial reporting and tax purposes. at the beginning of 2018, faulkner decided to change to the straight-line method for both financial reporting and tax purposes. a tax rate of 40% is in effect for all years. for an asset that cost $21,000 with an estimated residual value of $1,000 and an estimated useful life of 10 years, the depreciation under different methods is as follows:

Answers: 3

Another question on Business

Business, 22.06.2019 10:20

Sye chase started and operated a small family architectural firm in 2016. the firm was affected by two events: (1) chase provided $25,000 of services on account, and (2) he purchased $2,800 of supplies on account. there were $250 of supplies on hand as of december 31, 2016. record the two transactions in the accounts. record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. post the entries in the t-accounts and prepare a post-closing trial balance.

Answers: 1

Business, 22.06.2019 13:30

What do you recommend adam do to increase production in a business setting that does not seem to value high productivity?

Answers: 3

Business, 22.06.2019 14:20

Your uncle borrows $53,000 from the bank at 11 percent interest over the nine-year life of the loan. use appendix d for an approximate answer but calculate your final answer using the formula and financial calculator methods. what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest

Answers: 1

Business, 22.06.2019 19:30

Anew firm is developing its business plan. it will require $615,000 of assets, and it projects $450,000 of sales and $355,000 of operating costs for the first year. management is reasonably sure of these numbers because of contracts with its customers and suppliers. it can borrow at a rate of 7.5%, but the bank requires it to have a tie of at least 4.0, and if the tie falls below this level the bank will call in the loan and the firm will go bankrupt. what is the maximum debt ratio the firm can use? (hint: find the maximum dollars of interest, then the debt that produces that interest, and then the related debt ratio.)a. 41.94%b. 44.15%c. 46.47%d. 48.92%e. 51.49%

Answers: 3

You know the right answer?

During 2016 and 2017, faulkner manufacturing used the sum-of-the-years’-digits (syd) method of depre...

Questions

History, 31.08.2019 06:30

History, 31.08.2019 06:30

History, 31.08.2019 06:30

History, 31.08.2019 06:30

Business, 31.08.2019 06:30

Mathematics, 31.08.2019 06:30