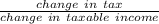

Arlene is single and ahas taxable income of $34000. her tax liability is currently $4636. she has the opportunity to earn an additional $6000 this year. her tax liability will grow to $5771 if she receives the additional income. what is arlene's marginal tax rate for the additional $6000?

Answers: 1

Another question on Business

Business, 22.06.2019 06:30

73. calculate the weighted average cost of capital (wacc) based on the following information: the equity multiplier is 1.66; the interest rate on debt is 13%; the required return to equity holders is 22%; and the tax rate is 35%. (a) 15.6% (b) 16.0% (c) 15.0% (d) 16.6% (e) none of the above

Answers: 2

Business, 22.06.2019 07:30

Jewelry manufacturers produce a range of products such as rings, necklaces, bracelets, and brooches. what fundamental economic question are they addressing by offering this range of items?

Answers: 3

Business, 22.06.2019 11:50

Select the correct answer. ramon applied to the state university in the city where he lives, but he was denied admission. what should he do now? a.change his mind about graduating and drop out of high school so he can start working right away. b. decide not to go to college, because he didn’t have a backup plan. c.stay positive and write a mean letter to let the college know that they made a bad decision. d. learn from this opportunity, reevaluate his options, and apply to his second and third choices.

Answers: 2

Business, 22.06.2019 17:00

Cadbury has a chocolate factory in dunedin, new zealand. for easter, it makes two kinds of “easter eggs”: milk chocolate and dark chocolate. it cycles between producing milk and dark chocolate eggs. the table below provides data on these two products. demand (lbs per hour) milk: 500 dark: 200 switchover time (minutes) milk: 60 dark: 30 production rate per hour milk: 800 dark: 800 for example, it takes 30 minutes to switch production from milk to dark chocolate. demand for milk chocolate is higher (500lbs per hour versus 200 lbs per hour), but the line produces them at the same rate (when operating): 800 lbs per hour. a : suppose cadbury produces 2,334lbs milk chocolate and 1,652 lbs of dark chocolate in each cycle. what would be the maximum inventory (lbs) of milk chocolate? b : how many lbs of milk and dark chocolate should be produced with each cycle so as to satisfy demand while minimizing inventory?

Answers: 2

You know the right answer?

Arlene is single and ahas taxable income of $34000. her tax liability is currently $4636. she has th...

Questions

Physics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

English, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

English, 17.09.2020 01:01

English, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01