Business, 08.10.2019 18:20 20Tiglashou

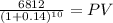

Your firm needs a machine which costs $260,000, and requires $47,000 in maintenance for each year of its 10 year life. after 5 years, this machine will be replaced. the machine falls into the macrs 10-year class life category. assume a tax rate of 40% and a discount rate of 14%. what is the depreciation tax shield for this project in year 10?

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

If delta airlines were to significantly change its fare structure and flight schedule to enhance its competitive position in response to aggressive price cutting by southwest airlines, this would be an example ofanswers: explicit collusion.tacit collusion.competitive dynamics.a harvest strategy.

Answers: 3

Business, 22.06.2019 11:30

Chuck, a single taxpayer, earns $80,750 in taxable income and $30,750 in interest from an investment in city of heflin bonds. (use the u.s. tax rate schedule.) (do not round intermediate calculations. round your answers to 2 decimal places.)

Answers: 2

Business, 22.06.2019 15:00

Ineed this asap miguel's boss asks him to distribute information to the entire staff about a mandatory meeting. in 1–2 sentences, describe what miguel should do.

Answers: 1

Business, 22.06.2019 17:30

An essential element of being receptive to messages is to have an open mind true or false

Answers: 2

You know the right answer?

Your firm needs a machine which costs $260,000, and requires $47,000 in maintenance for each year of...

Questions

English, 28.03.2020 05:26

Mathematics, 28.03.2020 05:26

Mathematics, 28.03.2020 05:26

Mathematics, 28.03.2020 05:27

English, 28.03.2020 05:27

Mathematics, 28.03.2020 05:27

Mathematics, 28.03.2020 05:27

Mathematics, 28.03.2020 05:27

History, 28.03.2020 05:27

Mathematics, 28.03.2020 05:27

History, 28.03.2020 05:27

Mathematics, 28.03.2020 05:27

Mathematics, 28.03.2020 05:27

Chemistry, 28.03.2020 05:27

Mathematics, 28.03.2020 05:27