Business, 10.10.2019 00:30 saigeshort

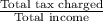

Consider the following hypothetical income tax brackets for a married couple. assume for simplicity there are no exemptions or deductions. income tax rate $0-$20,000 5% $20,000-$50,000 20 $50,000-$100,000 45 over $100,000 55 suppose the couple's income is $60 comma 000. what is the couple's marginal tax rate? the couple's marginal tax rate is 45 percent. (enter your response as an integer.) what is their average tax rate? the couple's average tax rate is nothing percent. (enter your response as an integer)

Answers: 2

Another question on Business

Business, 21.06.2019 19:30

What would be the input, conversion and output of developing a new soft drink

Answers: 3

Business, 22.06.2019 08:30

Hi inr 2002 class! i just uploaded a detailed study guide for this class. you can check-out a free preview by following the link below feel free to reach-out to me if you need a study buddy or have any questions. goodluck!

Answers: 1

Business, 22.06.2019 17:00

Jillian wants to plan her finances because she wants to create and maintain her tax and credit history. she also wants to chart out all of her financial transactions for the past federal fiscal year. what duration should jillian consider to calculate her finances? from (march or january )to (december or april)?

Answers: 1

Business, 23.06.2019 12:00

Whats a person that is involved in the business of buying and selling home

Answers: 2

You know the right answer?

Consider the following hypothetical income tax brackets for a married couple. assume for simplicity...

Questions

History, 23.04.2021 09:40

Computers and Technology, 23.04.2021 09:40

Computers and Technology, 23.04.2021 09:40

Biology, 23.04.2021 09:40

Computers and Technology, 23.04.2021 09:40

History, 23.04.2021 09:40

Mathematics, 23.04.2021 09:40

Mathematics, 23.04.2021 09:40

Chemistry, 23.04.2021 09:40

Spanish, 23.04.2021 09:40

Business, 23.04.2021 09:40

Mathematics, 23.04.2021 09:40

Mathematics, 23.04.2021 09:40

Biology, 23.04.2021 09:40

Mathematics, 23.04.2021 09:40