Business, 10.10.2019 05:00 moneymaleia9264

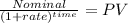

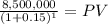

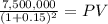

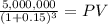

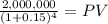

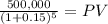

Carlisle enterprises, a specialty pharmaceutical manufacturer, has been losing market share for three years because several key patents have expired. free cash flow to the firm is expected to decline rapidly as more competitive generic drugs enter the market. projected cash flows for the next five years are $8.5 million, $7 million, $5 million, $2 million, and $0.5 million. cash flow after the fifth year is expected to be negligible. the firm’s board has decided to sell the firm to a larger pharmaceutical company that is interested in using carlisle’s product offering to fill gaps in its own product offering until it can develop similar drugs. carlisle’s weighted average cost of capital is 15%. what purchase price must carlisle obtain to earn its cost of capital?

Answers: 2

Another question on Business

Business, 22.06.2019 00:40

Gdonald was unhappy that his company did not provide good transport facilities. he found it very strenuous to drive to work on his own, and this eventually led to job dissatisfaction. hence, he recommended ways to solve this problem. according to the evln model, this information suggests that donald's main reaction to job dissatisfaction was:

Answers: 3

Business, 22.06.2019 06:30

Ummit record company is negotiating with two banks for a $157,000 loan. fidelity bank requires a compensating balance of 24 percent, discounts the loan, and wants to be paid back in four quarterly payments. southwest bank requires a compensating balance of 12 percent, does not discount the loan, but wants to be paid back in 12 monthly installments. the stated rate for both banks is 9 percent. compensating balances will be subtracted from the $157,000 in determining the available funds in part a. a-1. calculate the effective interest rate for fidelity bank and southwest bank. (do not round intermediate calculations. input your answers as a percent rounded to 2 decimal places.) a-2. which loan should summit accept? southwest bank fidelity bank b. recompute the effective cost of interest, assuming that summit ordinarily maintains $37,680 at each bank in deposits that will serve as compensating balances

Answers: 1

Business, 22.06.2019 11:00

The following information is available for ellen's fashions, inc. for the current month. book balance end of month $ 7 comma 000 outstanding checks 700 deposits in transit 4 comma 500 service charges 120 interest revenue 45 what is the adjusted book balance on the bank reconciliation?

Answers: 2

You know the right answer?

Carlisle enterprises, a specialty pharmaceutical manufacturer, has been losing market share for thre...

Questions

Computers and Technology, 12.11.2020 06:10

Biology, 12.11.2020 06:10

Physics, 12.11.2020 06:10

Mathematics, 12.11.2020 06:10

Mathematics, 12.11.2020 06:10

Biology, 12.11.2020 06:10

English, 12.11.2020 06:20

Computers and Technology, 12.11.2020 06:20

Health, 12.11.2020 06:20

Chemistry, 12.11.2020 06:20

Mathematics, 12.11.2020 06:20

Mathematics, 12.11.2020 06:20