Business, 10.10.2019 23:00 teddylove2643

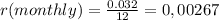

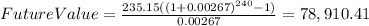

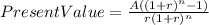

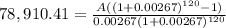

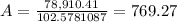

You plan on making a $235.15 monthly deposit into an account that pays 3.2% interest, compounded monthly, for 20 years. at the end of this period, you plan on withdrawing regular monthly payments. determine the amount that you can withdraw each month for 10 years, if you plan on not having anything in the account at the end of the 10 year period and no future deposits are made to the account. a. $769.27 b. $767.23 c. $78,910.41 d. $79,120.84 select the best answer from the choices provided a b c d

Answers: 3

Another question on Business

Business, 21.06.2019 19:20

Which of the following accurately describes a surplus? a. consumer demand for a certain car is below the number of cars that are produced. b. the production costs for a certain car are below the sale price of that car. c. a reduction in the cost of steel enables a car company to reduce the sale price of its cars. d. a car company tries to charge too high a price for a car and has to reduce the price. 2b2t

Answers: 1

Business, 22.06.2019 03:30

Eagle sporting goods reported the following data at july ​31, 2016​, with amounts adapted in​ thousands: ​(click the icon to view the income​ statement.) ​(click the icon to view the statement of retained​ earnings.) ​(click the icon to view the balance​ sheet.) 1. compute eagle​'s net working capital. 2. compute eagle​'s current ratio. round to two decimal places. 3. compute eagle​'s debt ratio. round to two decimal places. do these values and ratios look​ strong, weak or​ middle-of-the-road? 1. compute eagle​'s net working capital. total current assets - total current liabilities = net working capital 99400 - 30000 = 69400 2. compute eagle​'s current ratio. ​(round answer to two decimal​ places.) total current assets / total current liabilities = current ratio 99400 / 30000 = 3.31 3. compute eagle​'s debt ratio. ​(round answer to two decimal​ places.) total liabilities / total assets = debt ratio 65000 / 130000 = 0.50 do these ratio values and ratios look​ strong, weak or​ middle-of-the-road? net working capital is ▾ . this means ▾ current assets exceed current liabilities current liabilities exceed current assets and is a ▾ negative positive sign. eagle​'s current ratio is considered ▾ middle-of-the-road. strong. weak. eagle​'s debt ratio is considered ▾ middle-of-the-road. strong. weak. choose from any list or enter any number in the input fields and then continue to the next question.

Answers: 3

Business, 22.06.2019 12:50

Jallouk corporation has two different bonds currently outstanding. bond m has a face value of $50,000 and matures in 20 years. the bond makes no payments for the first six years, then pays $2,100 every six months over the subsequent eight years, and finally pays $2,400 every six months over the last six years. bond n also has a face value of $50,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. the required return on both these bonds is 10 percent compounded semiannually. what is the current price of bond m and bond n?

Answers: 3

Business, 22.06.2019 14:50

One pound of material is required for each finished unit. the inventory of materials at the end of each month should equal 20% of the following month's production needs. purchases of raw materials for february would be budgeted to be:

Answers: 2

You know the right answer?

You plan on making a $235.15 monthly deposit into an account that pays 3.2% interest, compounded mon...

Questions

Mathematics, 17.05.2021 22:10

Mathematics, 17.05.2021 22:10

Business, 17.05.2021 22:10

Mathematics, 17.05.2021 22:10

Arts, 17.05.2021 22:10

Business, 17.05.2021 22:10

Mathematics, 17.05.2021 22:10

Mathematics, 17.05.2021 22:10

Mathematics, 17.05.2021 22:10

Mathematics, 17.05.2021 22:10

Mathematics, 17.05.2021 22:10

Mathematics, 17.05.2021 22:10

Mathematics, 17.05.2021 22:10