Business, 11.10.2019 01:10 thelonewolf5020

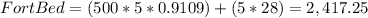

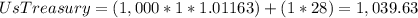

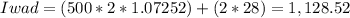

Broker k, who charges a fee of $28 for each bond sold, recommends that jim buy five par value $500 bonds from fort bend county, a par value $1,000 bond from the u. s. treasury, and two par value $500 bonds from iwad records. fort bend bonds are selling at 91.090, treasury bonds are selling at 101.163, and iwad records bonds are selling at 107.252. based on the current information, which broker’s bond package will cost jim less money up front, and how much less will it cost him?

Answers: 1

Another question on Business

Business, 22.06.2019 05:30

Find a company that has followed a strong strategic direction- state that generic strategy and the back-up points to support your position.

Answers: 1

Business, 22.06.2019 16:00

In microeconomics, the point at which supply and demand meet is called the blank price

Answers: 3

Business, 22.06.2019 21:10

Which of the following statements is (are) true? i. free entry to a perfectly competitive industry results in the industry's firms earning zero economic profit in the long run, except for the most efficient producers, who may earn economic rent. ii. in a perfectly competitive market, long-run equilibrium is characterized by lmc < p < latc. iii. if a competitive industry is in long-run equilibrium, a decrease in demand causes firms to earn negative profit because the market price will fall below average total cost.

Answers: 3

You know the right answer?

Broker k, who charges a fee of $28 for each bond sold, recommends that jim buy five par value $500 b...

Questions

Mathematics, 19.10.2019 12:30

Biology, 19.10.2019 12:30

Mathematics, 19.10.2019 12:30

Health, 19.10.2019 12:30

Physics, 19.10.2019 12:30

Mathematics, 19.10.2019 12:30

Mathematics, 19.10.2019 12:30

Mathematics, 19.10.2019 12:30

English, 19.10.2019 12:30