Business, 11.10.2019 05:10 tmrsavage02p7cj16

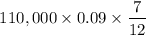

On june 1, 2016, oakcrest company signed a three-year $110,000 note payable with 9 percent interest. interest is due on june 1 of each year beginning in 2017. what amount of interest expense should be reported on the income statement for the year ended december 31, 2016?

Answers: 1

Another question on Business

Business, 22.06.2019 01:50

Amanda rice has just arranged to purchase a $640,000 vacation home in the bahamas with a 20 percent down payment. the mortgage has a 7 percent apr compounded monthly and calls for equal monthly payments over the next 30 years. her first payment will be due one month from now. however, the mortgage has an eight-year balloon payment, meaning that the balance of the loan must be paid off at the end of year 8. there were no other transaction costs or finance charges. how much will amanda’s balloon payment be in eight years

Answers: 3

Business, 22.06.2019 15:10

Paying attention to the purpose of her speech, which questions can she eliminate? a. 1 and 2 b. 3 c. 2 and 4 d. 1-4

Answers: 2

Business, 22.06.2019 19:50

Juan's investment portfolio was valued at $125,640 at the beginning of the year. during the year, juan received $603 in interest income and $298 in dividend income. juan also sold shares of stock and realized $1,459 in capital gains. juan's portfolio is valued at $142,608 at the end of the year. all income and realized gains were reinvested. no funds were contributed or withdrawn during the year. what is the amount of income juan must declare this year for income tax purposes?

Answers: 1

Business, 22.06.2019 20:20

Faldo corp sells on terms that allow customers 45 days to pay for merchandise. its sales last year were $325,000, and its year-end receivables were $60,000. if its dso is less than the 45-day credit period, then customers are paying on time. otherwise, they are paying late. by how much are customers paying early or late? base your answer on this equation: dso - credit period = days early or late, and use a 365-day year when calculating the dso. a positive answer indicates late payments, while a negative answer indicates early payments.a. 21.27b. 22.38c. 23.50d. 24.68e. 25.91b

Answers: 2

You know the right answer?

On june 1, 2016, oakcrest company signed a three-year $110,000 note payable with 9 percent interest....

Questions

French, 09.11.2020 18:40

Arts, 09.11.2020 18:40

Computers and Technology, 09.11.2020 18:40

Geography, 09.11.2020 18:40

Biology, 09.11.2020 18:40

Mathematics, 09.11.2020 18:40

History, 09.11.2020 18:40

Mathematics, 09.11.2020 18:40

Mathematics, 09.11.2020 18:40

Mathematics, 09.11.2020 18:40

Mathematics, 09.11.2020 18:40

English, 09.11.2020 18:40

Computers and Technology, 09.11.2020 18:40

Mathematics, 09.11.2020 18:40

Health, 09.11.2020 18:40