Business, 14.10.2019 17:30 emilypzamora11

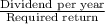

E-eyes has a new issue of preferred stock it calls 20/20 preferred. the stock will pay a $20 dividend per year, but the first dividend will not be paid until 20 years from today. if you require a return of 7.3 percent on this stock, how much should you pay today?

Answers: 3

Another question on Business

Business, 22.06.2019 10:30

Zapper has beginning equity of $257,000, net income of $51,000, dividends of $40,000 and investments by stockholders of $6,000. its ending equity is

Answers: 2

Business, 22.06.2019 17:00

Afinancing project has an initial cash inflow of $42,000 and cash flows of −$15,600, −$22,200, and −$18,000 for years 1 to 3, respectively. the required rate of return is 13 percent. what is the internal rate of return? should the project be accepted?

Answers: 1

Business, 22.06.2019 18:00

David paid $975,000 for two beachfront lots in coastal south carolina, with the intention of building residential homes on each. two years later, the south carolina legislature passed the beachfront management act, barring any further development of the coast, including david's lots. when david files a complaint to seek compensation for his property, south carolina refuses, pointing to a passage in david's own complaint that states "the beachfront management act [was] properly and validly designed to south carolina's " is south carolina required to compensate david under the takings clause?

Answers: 1

Business, 22.06.2019 19:00

Gus needs to purée his soup while it's still in the pot. what is the best tool for him to use? a. potato masher b. immersion blender c. rotary mixer d. whisk

Answers: 2

You know the right answer?

E-eyes has a new issue of preferred stock it calls 20/20 preferred. the stock will pay a $20 dividen...

Questions

Mathematics, 31.01.2020 05:50

Chemistry, 31.01.2020 05:50

Mathematics, 31.01.2020 05:50

Mathematics, 31.01.2020 05:50

Mathematics, 31.01.2020 05:50

Mathematics, 31.01.2020 05:50

Spanish, 31.01.2020 05:50

Social Studies, 31.01.2020 05:50

Mathematics, 31.01.2020 05:50

Mathematics, 31.01.2020 05:50

Health, 31.01.2020 05:50

Mathematics, 31.01.2020 05:50

History, 31.01.2020 05:50

Mathematics, 31.01.2020 05:50