Business, 16.10.2019 02:20 mwilliams457

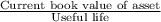

An intangible asset with an estimated useful life of 30 years was acquired on january 1, 2007, for $540,000. on january 1, 2017, a review was made of intangible assets and their expected service lives, and it was determined that this asset had an estimated useful life of 30 more years from the date of the review. what is the amount of amortization for this intangible in 2017

Answers: 2

Another question on Business

Business, 22.06.2019 09:30

Oliver's company is planning the launch of their hybrid cars. the company has included "never-before-seen" product benefits in the hybrid cars. which type of advertising should oliver's company use for the new cars?

Answers: 1

Business, 22.06.2019 12:40

Which of the following tasks would be a line cook's main responsibility? oa. frying french fries ob. chopping onions oc. taking inventory of stocked dry goods od. paying invoices

Answers: 2

Business, 22.06.2019 18:00

Interpreting the income tax expense footnote the income tax footnote to the financial statements of fedex corporation follows. the components of the provision for income taxes for the years ended may 31 were as follows: ($ millions) 2010 2009 2008 current provision domestic federal $ 36 $ (35) $ 514 state and local 54 18 74 foreign 207 214 242 297 197 830 deferred provisions (benefit) domestic federal 408 327 31 state and local 15 48 (2) foreign (10) 7 32 413 382 61 provision for income taxes $ 710 $ 579 $ 891 (a)what is the amount of income tax expense reported in fedex's 2010, 2009, and 2008 income statements?

Answers: 2

You know the right answer?

An intangible asset with an estimated useful life of 30 years was acquired on january 1, 2007, for $...

Questions

Law, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01

Computers and Technology, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01

English, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01

English, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01