Business, 16.10.2019 06:00 alimfelipe

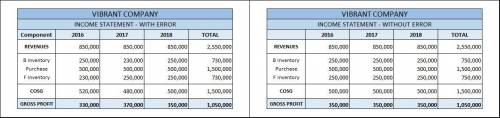

Vibrant company had $850,000 of sales in each of three consecutive years 2016–2018, and it purchased merchandise costing $500,000 in each of those years. it also maintained a $250,000 physical inventory from the beginning to the end of that three-year period. in accounting for inventory, it made an error at the end of year 2016 that caused its year-end 2016 inventory to appear on its statements as $230,000 rather than the correct $250,000. required: 1. determine the correct amount of the company's gross profit in each of the years 2016−2018. 2. prepare comparative income statements to show the effect of this error on the company's cost of goods sold and gross profit for each of the years 2016−2018.

Answers: 1

Another question on Business

Business, 22.06.2019 12:30

In the 1970s, kmart used blue light specials to encourage customers to flock to a particular department having a temporary sale. a spinning blue light activated for approximately 30 seconds, and then an in-store announcement informed shoppers of the special savings in the specific department. over time, loyal kmart shoppers learned to flock to the department with the spinning blue light before any announcement of special savings occurred. if kmart was employing classical conditioning techniques, what role did the spinning blue light play?

Answers: 3

Business, 22.06.2019 12:50

Kendrick is leaving his current position at a company, and charlize is taking over. kendrick set up his powerpoint for easy access for himself. charlize needs to work in the program that is easy for her to use. charlize should reset advanced options

Answers: 3

Business, 22.06.2019 18:50

)a business incurs the following costs per unit: labor $125/unit, materials $45/unit, and rent $250,000/month. if the firm produces 1,000,000 units a month, calculate the following: a. total variable costs b. total fixed costs c. total costs

Answers: 1

Business, 23.06.2019 00:40

Oliver queen buys 100 shares of stock in green arrow archery corporation, a publicly traded company with which he is not affiliated as a director, officer, or employee. he then sells his 100 shares to john diggle. the sec sues oliver because he didn't register the sale of stock to john. who wins? oliver, because the sale falls into the nonissuer exemption oliver, because the sale falls into the private placement exemption the sec, because the transaction is not exempt from registration the sec, because even exempt transactions must be registered with the sec

Answers: 3

You know the right answer?

Vibrant company had $850,000 of sales in each of three consecutive years 2016–2018, and it purchased...

Questions

Mathematics, 16.12.2020 08:10

Biology, 16.12.2020 08:10

Mathematics, 16.12.2020 08:10

Mathematics, 16.12.2020 08:10

Arts, 16.12.2020 08:10

Biology, 16.12.2020 08:10

Mathematics, 16.12.2020 08:10

Mathematics, 16.12.2020 08:10

English, 16.12.2020 08:10

Mathematics, 16.12.2020 08:10

Mathematics, 16.12.2020 08:10

Mathematics, 16.12.2020 08:10