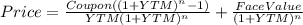

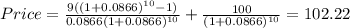

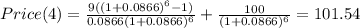

Suppose you purchase a ten-year bond with 9% annual coupons. you hold the bond for four years and sell it immediately after receiving the fourth coupon. if the bond’s ytm was 8.66% when you purchased and sold the bond. what cash flows will you pay at the purchase and what cash flows will you receive at the sale (including any coupon received immediately before sale) from you investment in the bond per $100 face value? how much interest income will you earn for holding this bond for four years in total?

Answers: 1

Another question on Business

Business, 21.06.2019 20:40

Which of the following actions is most likely to result in a decrease in the money supply? a. the discount rate on overnight loans is lowered. b. the government sells a new batch of treasury bonds. c. the federal reserve bank buys treasury bonds. d. the required reserve ratio for banks is decreased. 2b2t

Answers: 2

Business, 23.06.2019 04:00

Estimate the prouduct sovle using an area modelestimate the product you solve using an area model and the standard algorithm.remeber to express your products in the standard form

Answers: 3

Business, 23.06.2019 06:00

If a society decides to produce consumer goods from its available resources, it is answering the economic question

Answers: 1

You know the right answer?

Suppose you purchase a ten-year bond with 9% annual coupons. you hold the bond for four years and se...

Questions

Mathematics, 19.01.2021 21:00

Chemistry, 19.01.2021 21:00

Mathematics, 19.01.2021 21:00

Mathematics, 19.01.2021 21:00

Mathematics, 19.01.2021 21:00