Business, 19.10.2019 00:10 ARandomPersonOnline

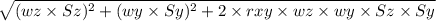

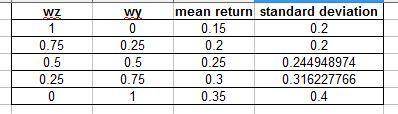

The expected returns and standard deviation of returns for two securities are as follows: security z security yexpected return 15% 35%standard deviation 20% 40%the correlation between the returns is + .25.(a) calculate the expected return and standard deviation for the following portfolios: 1i. all in zii. 75 in z and .25 in yiii. 5 in z and .5 in yiv. 25 in z and .75 in yv. all in y

Answers: 3

Another question on Business

Business, 22.06.2019 15:00

(a) what do you think will happen if the price of non-gm crops continues to rise? why? (b) what will happen if the price of non-gm food drops? why?

Answers: 2

Business, 22.06.2019 15:20

Gulliver travel agencies thinks interest rates in europe are low. the firm borrows euros at 5 percent for one year. during this time period the dollar falls 11 percent against the euro. what is the effective interest rate on the loan for one year? (consider the 11 percent fall in the value of the dollar as well as the interest payment.)

Answers: 2

Business, 22.06.2019 15:50

Singer and mcmann are partners in a business. singer’s original capital was $40,000 and mcmann’s was $60,000. they agree to salaries of $12,000 and $18,000 for singer and mcmann respectively and 10% interest on original capital. if they agree to share remaining profits and losses on a 3: 2 ratio, what will mcmann’s share of the income be if the income for the year was $15,000?

Answers: 1

Business, 22.06.2019 20:00

A$100 million interest rate swap has a remaining life of 10 months. under the terms of the swap, the six-month libor is exchanged semi-annually for 12% per annum. the six-month libor rate in swaps of all maturities is currently 10% per annum with continuous compounding. the six-month libor rate was 9.6% per annum two months ago. what is the current value of the swap to the party paying floating? what is its value to the party paying fixed?

Answers: 2

You know the right answer?

The expected returns and standard deviation of returns for two securities are as follows: security z...

Questions

Geography, 08.07.2019 21:00

Mathematics, 08.07.2019 21:00

History, 08.07.2019 21:00

Biology, 08.07.2019 21:00

Physics, 08.07.2019 21:00

Mathematics, 08.07.2019 21:00

History, 08.07.2019 21:00

Mathematics, 08.07.2019 21:00

Mathematics, 08.07.2019 21:00

Mathematics, 08.07.2019 21:00

Social Studies, 08.07.2019 21:00

Mathematics, 08.07.2019 21:00

Mathematics, 08.07.2019 21:00

Mathematics, 08.07.2019 21:00