Business, 19.10.2019 02:30 asalterasalter9211

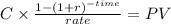

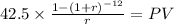

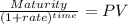

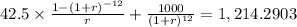

You own a bond with a par value of $1,000 and a coupon rate of 8.50% (semiannual coupon). you know it has a current yield of 7.00%. what is its yield to maturity? the bond has 6 years to maturity. current yield = (annual payment / price). (hint: solve for price to answer the question). the answer is 4.40% but i dont know how to get that answer. i have a hp 10bll + financial calculator but i dont know how to put this into the calculator

Answers: 3

Another question on Business

Business, 22.06.2019 03:00

Tina is applying for the position of a daycare assistant at a local childcare center. which document should tina send with a résumé to her potential employer? a. educational certificate b. work experience certificate c. cover letter d. follow-up letter

Answers: 1

Business, 22.06.2019 05:50

Match the steps for conducting an informational interview with the tasks in each step.

Answers: 1

Business, 22.06.2019 09:50

The returns on the common stock of maynard cosmetic specialties are quite cyclical. in a boom economy, the stock is expected to return 22 percent in comparison to 9 percent in a normal economy and a negative 14 percent in a recessionary period. the probability of a recession is 35 percent while the probability of a boom is 10 percent. what is the standard deviation of the returns on this stock?

Answers: 2

You know the right answer?

You own a bond with a par value of $1,000 and a coupon rate of 8.50% (semiannual coupon). you know i...

Questions

Arts, 03.12.2020 18:40

English, 03.12.2020 18:40

Arts, 03.12.2020 18:40

Mathematics, 03.12.2020 18:40

Mathematics, 03.12.2020 18:40

History, 03.12.2020 18:40

Mathematics, 03.12.2020 18:40

Mathematics, 03.12.2020 18:40

Mathematics, 03.12.2020 18:40

English, 03.12.2020 18:40

Mathematics, 03.12.2020 18:40