Business, 19.10.2019 03:10 shayleithomas

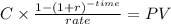

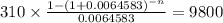

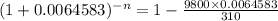

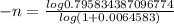

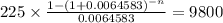

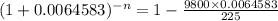

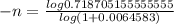

Currently, you owe the bank $9,800 for a car loan. the loan has an interest rate of 7.75 percent and monthly payments of $310. your financial situation recently changed such that you can no longer afford these payments. after talking with your banker and explaining the situation, he has agreed to lower the monthly payments to $225 while keeping the interest rate at 7.75 percent. how much longer will it take you to repay this loan than you had originally planned?

Answers: 2

Another question on Business

Business, 21.06.2019 20:20

Aproduction order quantity problem has a daily demand rate = 10 and a daily production rate = 50. the production order quantity for this problem is approximately 612 units. what is the average inventory for this problem?

Answers: 1

Business, 22.06.2019 12:20

Selected transactions of the carolina company are listed below. classify each transaction as either an operating activity, an investing activity, a financing activity, or a noncash activity. 1. common stock is sold for cash above par value. 2. bonds payable are issued for cash at a discount

Answers: 2

Business, 22.06.2019 16:30

Summarize the specific methods used by interest groups in order to influence governmental decisions making in all three branches of government. provide at least two examples from each branch.

Answers: 3

Business, 23.06.2019 00:00

Both a demand curve and a demand schedule show how a. prices affect consumer demand. b. consumer demand affects income. c. prices affect complementary goods. d. consumer demand affects substitute goods.

Answers: 2

You know the right answer?

Currently, you owe the bank $9,800 for a car loan. the loan has an interest rate of 7.75 percent and...

Questions

Mathematics, 01.05.2021 19:20

Mathematics, 01.05.2021 19:20

Mathematics, 01.05.2021 19:20

Mathematics, 01.05.2021 19:20

English, 01.05.2021 19:20

Mathematics, 01.05.2021 19:20

Mathematics, 01.05.2021 19:20

Computers and Technology, 01.05.2021 19:20