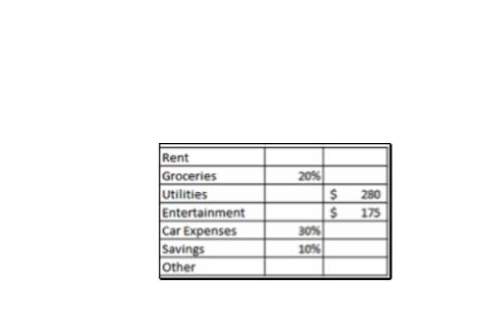

Amina makes $48,000 per year before taxes, and takes homes around $3,500 each month. given below is an unfinished table representing her monthly budget. complete the table and answer the questions below. (17 points: part i - 1 point; part ii 2 points; part iii - 1 point; part v - 5 points; part vi - 1 point; part vii - 6 points)

part i: what is the "rule of thumb" on how much amina should spend each month on rent? (1 point)

part ii: using the rule of thumb, calculate amina's monthly budget for rent. express the rent as a percentage of take-home pay ( round both answers to the nearest whole number). (2 points: 1 point each)

part iii: how much does amina spend each month on groceries? (1 point)

part iv: what percentage of her take-home pay is spent on utilities? (1 point)

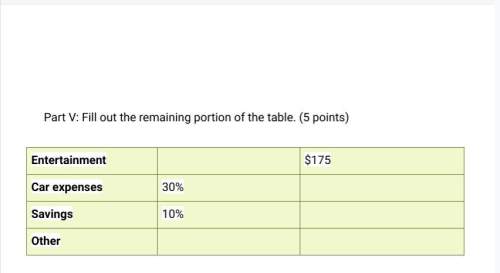

part v: fill out the remaining portion of the table. (5 points) (will provide pictures below)

part vi: arrange amina's expenses from greatest to least. (1 point)

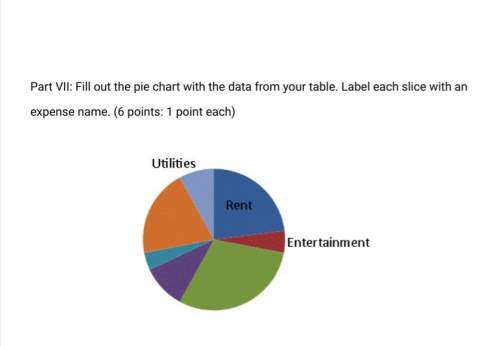

part vii: fill out the pie chart with the data from your table. label each slice with an expense name. (6 points: 1 point each)

Answers: 2

Another question on Business

Business, 21.06.2019 21:00

Consider a small island country whose only industry is weaving. the following table shows information about the small economy in two different years. complete the table by calculating physical capital per worker as well as labor productivity. hint: recall that productivity is defined as the amount of goods and services a worker can produce per hour. in this problem, measure productivity as the quantity of goods per hour of labor. year physical capital labor force physical capital per worker labor hours output labor productivity (looms) (workers) (looms) (hours) (garments) (garments per hour of labor) 2024 160 40 1,800 14,400 2025 180 60 3,900 23,400

Answers: 2

Business, 22.06.2019 14:50

Pear co.’s income statement for the year ended december 31, as prepared by pear’s controller, reported income before taxes of $125,000. the auditor questioned the following amounts that had been included in income before taxes: equity in earnings of cinn co. $ 40,000 dividends received from cinn 8,000 adjustments to profits of prior years for arithmetical errors in depreciation (35,000) pear owns 40% of cinn’s common stock, and no acquisition differentials are relevant. pear’s december 31 income statement should report income before taxes of

Answers: 3

Business, 22.06.2019 18:20

Now ray has had the tires for two months and he notices that the tread has started to pull away from the tire. he has already contacted the place who sold the tires and calmly and accurately explained the problem. they didn’t him because they no longer carry that tire. so he talked with the manager and he still did not get the tire replaced. his consumer rights are being violated. pretend you are ray and write a letter to the company’s headquarters. here are some points to keep in mind when writing the letter: include your name, address, and account number, if appropriate. describe your purchase (name of product, serial numbers, date and location of purchase). state the problem and give the history of how you tried to resolve the problem. ask for a specific action. include how you can be reached.

Answers: 3

Business, 22.06.2019 20:20

Garcia industries has sales of $200,000 and accounts receivable of $18,500, and it gives its customers 25 days to pay. the industry average dso is 27 days, based on a 365-day year. if the company changes its credit and collection policy sufficiently to cause its dso to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant? a. $241.45b. $254.16c. $267.54d. $281.62e. $296.44

Answers: 2

You know the right answer?

Amina makes $48,000 per year before taxes, and takes homes around $3,500 each month. given below is...

Questions

Geography, 08.01.2020 00:31

Biology, 08.01.2020 00:31

Mathematics, 08.01.2020 00:31

Business, 08.01.2020 00:31