Business, 24.10.2019 02:00 ImmortalEnigmaYT

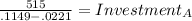

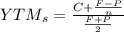

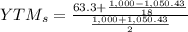

Kyan owns investment a and 1 bond b. the total value of his holdings is $6,600. investment a is expected to pay annual cash flows to kyan forever with the first annual cash flow expected in 1 year from today. investment a has an expected return of 11.49 percent. the first cash flow is expected to be $515 in 1 year and annual cash flows are expected to increase by 2.21 percent each year forever. bond b pays semi-annual coupons, matures in 9 years, has a face value of $1000, has a coupon rate of 12.66 percent, and pays its next coupon in 6 months. what is the yield-to-maturity for bond b? answer as a rate in decimal format so that 12.34% would be entered as .1234 and 0.98% would be entered as .0098.

Answers: 2

Another question on Business

Business, 21.06.2019 15:40

There is a cost associated with each source of financing. discuss the cost of debt, preferred stock, common stock, and retained earnings in detail. which source of financing is typically less expensive? why? why do financial managers try to determine the optimal capital mix? be specific.

Answers: 1

Business, 21.06.2019 21:00

In order to minimize project risk which step comes after the step of identifying risks

Answers: 1

Business, 22.06.2019 00:00

When is going to be why would you put money into saving account

Answers: 1

Business, 22.06.2019 11:10

The prebisch–singer hypothesis concludes that: a. technology lowers the cost of manufactured products, so developing countries should see an increase in their terms of trade. b. developing countries experience a long-run decline in their terms of trade, as the demand for primary products in higher-income countries declines relative to their demand for manufactured goods. c. because of unfair trading practices, labor in developing countries is exploited. d. opec has been responsible for a slowdown in the world's standard of living.

Answers: 3

You know the right answer?

Kyan owns investment a and 1 bond b. the total value of his holdings is $6,600. investment a is expe...

Questions

Mathematics, 22.03.2020 05:48

Spanish, 22.03.2020 05:49

Biology, 22.03.2020 05:50

History, 22.03.2020 05:51

Mathematics, 22.03.2020 05:51

Mathematics, 22.03.2020 05:52

Social Studies, 22.03.2020 05:52

Chemistry, 22.03.2020 05:52

Biology, 22.03.2020 05:52

English, 22.03.2020 05:53

Mathematics, 22.03.2020 05:53

Mathematics, 22.03.2020 05:53

Mathematics, 22.03.2020 05:53

Mathematics, 22.03.2020 05:53