Business, 26.10.2019 00:43 JohnBranks3258

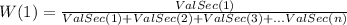

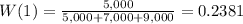

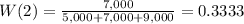

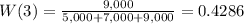

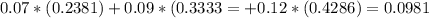

Security $ invested expected return 1 $5,000 7% 2 $7,000 9% 3 $9,000 12% give the data above: what is the weight of security 1? (show your work. label %. one decimal place required. highlight or bold your answer.) what is the weight of security 2? (show your work. label %. one decimal place required. highlight or bold your answer.) what is the weight of security 3? (show your work. label %. one decimal place required. highlight or bold your answer.) what is the expected return on the portfolio? (show your work. label %. two decimal places required. highlight or bold your answer.)

Answers: 1

Another question on Business

Business, 22.06.2019 01:40

Kis the insured and p is the sole beneficiary on a life insurance policy. both are involved in a fatal accident where k dies before p. under the common disaster provision, which of these statements is true?

Answers: 1

Business, 22.06.2019 12:50

Explain whether each of the following events increases or decreases the money supply. a. the fed buys bonds in open-market operations. b. the fed reduces the reserve requirement. c. the fed increases the interest rate it pays on reserves. d. citibank repays a loan it had previously taken from the fed. e. after a rash of pickpocketing, people decide to hold less currency. f. fearful of bank runs, bankers decide to hold more excess reserves. g. the fomc increases its target for the federal funds rate.

Answers: 3

Business, 22.06.2019 20:10

With signals from no-claim bonuses and deductibles, a. the marginal cost curve for careful drivers lies to the left of the marginal cost curve for aggressive drivers b. auto insurance companies insure more aggressive drivers than careful drivers because aggressive drivers have a greater need for the insurance c. the market for car insurance has a separating equilibrium, and the market is efficient d. most drivers pay higher premiums than if the market had no signals

Answers: 1

You know the right answer?

Security $ invested expected return 1 $5,000 7% 2 $7,000 9% 3 $9,000 12% give the data above: what...

Questions

Physics, 18.10.2020 05:01

Mathematics, 18.10.2020 05:01

Spanish, 18.10.2020 05:01

History, 18.10.2020 05:01

Mathematics, 18.10.2020 05:01

Mathematics, 18.10.2020 05:01

Mathematics, 18.10.2020 05:01

English, 18.10.2020 05:01