Business, 28.10.2019 21:31 dariannalopez5902

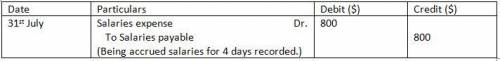

Molly mocha employs one college student every summer in her coffee shop. the student works the five weekdays and is paid on the following monday. (for example, a student who works monday through friday, june 1 through june 5, is paid for that work on monday, june 8.) the coffee shop adjusts its books monthly, if needed, to show salaries earned but unpaid at month-end. the student works the last week of july, which is monday, july 28, through friday, august 1. if the student earns $200 per day, what adjusting entry must the coffee shop make on july 31 to correctly record accrued salaries expense for july?

Answers: 2

Another question on Business

Business, 21.06.2019 21:40

Morgana company identifies three activities in its manufacturing process: machine setups, machining, and inspections. estimated annual overhead cost for each activity is $168,000, $315,900, an $97,200, respectively. the cost driver for each activity and the expected annual usage are number of setups 2,100, machine hours 24,300, and number of inspections 1,800. compute the overhead rate for each activity. machine setups $ per setup machining $ per machine hour inspections $ per inspection

Answers: 1

Business, 22.06.2019 07:00

Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings before interest and taxes (ebit) are $80,000. pp's current cost of equity is 10%, and its tax rate is 40%. the firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. refer to the data for pennewell publishing inc. (pp). pp is considering changing its capital structure to one with 30% debt and 70% equity, based on market values. the debt would have an interest rate of 8%. the new funds would be used to repurchase stock. it is estimated that the increase in risk resulting from the added leverage would cause the required rate of return on equity to rise to 12%. if this plan were carried out, what would be pp's new value of operations? a. $484,359 b. $521,173 c. $584,653 d. $560,748 e. $487,805

Answers: 1

Business, 22.06.2019 10:30

You meet that special person and get married. amazingly your spouse has exactly the same income you do 47,810. if your tax status is now married filing jointly what is your tax liability

Answers: 2

You know the right answer?

Molly mocha employs one college student every summer in her coffee shop. the student works the five...

Questions

Social Studies, 04.02.2021 20:50

Mathematics, 04.02.2021 20:50

Geography, 04.02.2021 20:50

Mathematics, 04.02.2021 20:50

Social Studies, 04.02.2021 20:50

English, 04.02.2021 20:50

Mathematics, 04.02.2021 20:50

Mathematics, 04.02.2021 20:50

Mathematics, 04.02.2021 20:50

Mathematics, 04.02.2021 20:50

History, 04.02.2021 20:50