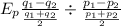

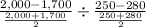

Consider airfares on flights between new york and minneapolis. when the airfare is $250, the quantity demanded of tickets is 2,000 per week. when the airfare is $280, the quantity demanded of tickets is 1,700 per week. using the midpoint method, a the price elasticity of demand is about 0.70 and an increase in the airfare will cause airlines' total revenue to decrease. b the price elasticity of demand is about 1.43 and an increase in the airfare will cause airlines' total revenue to increase. c the price elasticity of demand is about 1.43 and an increase in the airfare will cause airlines' total revenue to decrease. d the price elasticity of demand is about 0.70 and an increase in the airfare will cause airlines' total revenue to increase.

Answers: 1

Another question on Business

Business, 21.06.2019 14:00

Will you use single-entry bookkeeping or double-entry bookkeeping? explain why.

Answers: 1

Business, 21.06.2019 20:30

Which of the following statements regarding the learning curve and economies of scale is accurate? answers: just as diseconomies of scale are presumed to exist if a firm gets too large, there is a corresponding increase in costs in the learning-curve model as the cumulative volume of production grows.where diseconomies of scale are presumed to exist if a firm gets too large, there is no corresponding increase in costs in the learning-curve model as the cumulative volume of production grows.where diseconomies of scale are presumed to exist if a firm gets too small, there is no corresponding increase in costs in the learning-curve model as the cumulative volume of production grows.just as diseconomies of scale are presumed to exist if a firm gets too small, there is a corresponding increase in costs in the learning-curve model as the cumulative volume of production grows.

Answers: 1

Business, 22.06.2019 12:50

You own 2,200 shares of deltona hardware. the company has stated that it plans on issuing a dividend of $0.42 a share at the end of this year and then issuing a final liquidating dividend of $2.90 a share at the end of next year. your required rate of return on this security is 16 percent. ignoring taxes, what is the value of one share of this stock to you today?

Answers: 1

Business, 22.06.2019 18:40

Under t, the point (0,2) gets mapped to (3,0). t-1 (x,y) →

Answers: 3

You know the right answer?

Consider airfares on flights between new york and minneapolis. when the airfare is $250, the quantit...

Questions

Mathematics, 10.11.2019 20:31

Mathematics, 10.11.2019 20:31

Arts, 10.11.2019 20:31

Social Studies, 10.11.2019 20:31

Biology, 10.11.2019 20:31

History, 10.11.2019 20:31

Mathematics, 10.11.2019 20:31

English, 10.11.2019 20:31

Mathematics, 10.11.2019 20:31

Mathematics, 10.11.2019 20:31

English, 10.11.2019 20:31