Business, 29.10.2019 21:31 vjackie101ov3kju

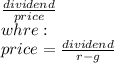

Which of the following statements is correct? group of answer choices the constant growth model is often appropriate for evaluating start-up companies that do not have a stable history of growth but are expected to reach stable growth within the next few years. if a stock has a required rate of return rs = 12% and its dividend is expected to grow at a constant rate of 5%, then the stock’s dividend yield is also 5%. the price of a stock is the present value of all expected future dividends, discounted at the dividend growth rate. the stock valuation model, p0 = d1/(rs - g), can be used to value firms whose dividends are expected to decline at a constant rate, i. e., to grow at a negative rate. the constant growth model cannot be used for a zero growth stock, wherein the dividend is expected to remain constant over time.

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

What does the phrase limited liability mean in a corporate context?

Answers: 2

Business, 22.06.2019 06:40

Burke enterprises is considering a machine costing $30 billion that will result in initial after-tax cash savings of $3.7 billion at the end of the first year, and these savings will grow at a rate of 2 percent per year for 11 years. after 11 years, the company can sell the parts for $5 billion. burke has a target debt/equity ratio of 1.2, a beta of 1.79. you estimate that the return on the market is 7.5% and t-bills are currently yielding 2.5%. burke has two issuances of bonds outstanding. the first has 200,000 bonds trading at 98% of par, with coupons of 5%, face of $1000, and maturity of 5 years. the second has 500,000 bonds trading at par, with coupons of 7.5%, face of $1000, and maturity of 12 years. kate, the ceo, usually applies an adjustment factor to the discount rate of +2 for such highly innovative projects. should the company take on the project?

Answers: 1

Business, 22.06.2019 22:50

Suppose that the u.s. dollars-mexican pesos exchange rate is fixed by the u.s. and mexican governments. assume also that labor is mobile between the united states and mexico due to low transportation costs.which of the following situations is likely to happen as a result of a simultaneous increase in the demand for u.s. goods and decrease in the demand for mexican goods? (pick mexican unemployment rate increases, and the country undergoes bad economic times for a sustained u.s. unemployment rate increases, and the country undergoes bad economic times for a sustained mexican unemployment rate rises at first, but it soon drops as unemployed mexicans move to the united states for mexican unemployment rate rises at first, but then it drops as mexican pesos depreciate against u.s. dollars.

Answers: 1

You know the right answer?

Which of the following statements is correct? group of answer choices the constant growth model is...

Questions

Geography, 19.11.2020 01:00

Physics, 19.11.2020 01:00

English, 19.11.2020 01:00

Mathematics, 19.11.2020 01:00

History, 19.11.2020 01:00

English, 19.11.2020 01:00

Arts, 19.11.2020 01:00

Mathematics, 19.11.2020 01:00

Mathematics, 19.11.2020 01:00

History, 19.11.2020 01:00

English, 19.11.2020 01:00

English, 19.11.2020 01:00

Mathematics, 19.11.2020 01:00

Mathematics, 19.11.2020 01:00