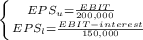

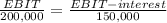

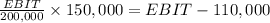

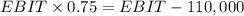

Franklin corporation is comparing two different capital structures, an all-equity plan (plan i) and a levered plan (plan ii). under plan i, the company would have 200,000 shares of stock outstanding. under plan ii, there would be 150,000 shares of stock outstanding and $2.2 million in debt outstanding. the interest rate on the debt is 5 percent and there are no taxes.

a. if ebit is $350,000, what is the eps for each plan? (do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.)

eps

plan i $

plan ii $

b. if ebit is $600,000, what is the eps for each plan? (do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.)

eps

plan i $

plan ii $

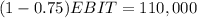

c. what is the break-even ebit? (enter your answer in dollars, not millions of dollars, e. g., 1,234,567. do not round intermediate calculations and round your answer to the nearest whole number, e. g., 32.)

break-even ebit $

Answers: 1

Another question on Business

Business, 22.06.2019 04:30

What is the second step in communication planning? determine the purpose of the message outline the communication for delivery determine the best channel of communication clarify objectives identify the audience

Answers: 2

Business, 22.06.2019 09:00

Harry is 25 years old with a 1.55 rating factor for his auto insurance. if his annual base premium is $1,012, what is his total premium? $1,568.60 $2,530 $1,582.55 $1,842.25

Answers: 3

Business, 22.06.2019 15:30

The school cafeteria can make pizza for approximately $0.30 a slice. the cost of kitchen use and cafeteria staff runs about $200 per day. the pizza den nearby will deliver whole pizzas for $9.00 each. the cafeteria staff cuts the pizza into eight slices and serves them in the usual cafeteria line. with no cooking duties, the staff can be reduced by half, for a fixed cost of $75 per day. should the school cafeteria make or buy its pizzas?

Answers: 3

Business, 22.06.2019 16:20

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks. the portfolio's beta is 1.25. now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.55. what would the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

You know the right answer?

Franklin corporation is comparing two different capital structures, an all-equity plan (plan i) and...

Questions

Mathematics, 24.10.2021 04:10

Mathematics, 24.10.2021 04:10

Mathematics, 24.10.2021 04:10

Computers and Technology, 24.10.2021 04:10

Mathematics, 24.10.2021 04:10

Chemistry, 24.10.2021 04:10

Mathematics, 24.10.2021 04:10

Health, 24.10.2021 04:10

Social Studies, 24.10.2021 04:10

English, 24.10.2021 04:10

Biology, 24.10.2021 04:20

Social Studies, 24.10.2021 04:20