Business, 30.10.2019 07:31 shaheedbrown06

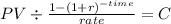

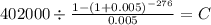

11. nadine is retiring at age 62 and expects to live to age 85. on the day she retires, she has $402,000 in her retirement savings account. she is somewhat conservative with her money and expects to earn 6 percent during her retirement years. how much can she withdraw from her retirement savings each month if she plans to spend her last penny on the morning of her death? a. $1,909.92 b. $2,147.78 c. $2,219.46 d. $2,416.08 e. $2,688.77

Answers: 1

Another question on Business

Business, 22.06.2019 05:20

What are the general categories of capital budget scenarios? describe the overall decision-making context for each.

Answers: 3

Business, 22.06.2019 12:50

Salaries are $4,500 per week for five working days and are paid weekly at the end of the day fridays. the end of the month falls on a thursday. the accountant for dayton company made the appropriate accrual adjustment and posted it to the ledger. the balance of salaries payable, as shown on the adjusted trial balance, will be a (assume that there was no beginning balance in the salaries payable account.)

Answers: 1

Business, 22.06.2019 13:10

Thomas kratzer is the purchasing manager for the headquarters of a large insurance company chain with a central inventory operation. thomas's fastest-moving inventory item has a demand of 6,000 units per year. the cost of each unit is $100, and the inventory carrying cost is $10 per unit per year. the average ordering cost is $30 per order. it takes about 5 days for an order to arrive, and the demand for 1 week is 120 units. (this is a corporate operation, and the are 250 working days per year.)a) what is the eoq? b) what is the average inventory if the eoq is used? c) what is the optimal number of orders per year? d) what is the optimal number of days in between any two orders? e) what is the annual cost of ordering and holding inventory? f) what is the total annual inventory cost, including cost of the 6,000 units?

Answers: 3

Business, 22.06.2019 15:40

As sales exceed the break‑even point, a high contribution‑margin percentage (a) increases profits faster than does a low contribution-margin percentage (b) increases profits at the same rate as a low contribution-margin percentage (c) decreases profits at the same rate as a low contribution-margin percentage (d) increases profits slower than does a low contribution-margin percentage

Answers: 1

You know the right answer?

11. nadine is retiring at age 62 and expects to live to age 85. on the day she retires, she has $402...

Questions

Mathematics, 10.05.2021 14:30

Mathematics, 10.05.2021 14:30

Computers and Technology, 10.05.2021 14:30

Mathematics, 10.05.2021 14:30

English, 10.05.2021 14:30

Mathematics, 10.05.2021 14:30

Social Studies, 10.05.2021 14:30

Social Studies, 10.05.2021 14:30

English, 10.05.2021 14:30

Mathematics, 10.05.2021 14:30

English, 10.05.2021 14:30

Mathematics, 10.05.2021 14:30