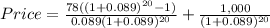

Even though most corporate bonds in the united states make coupon payments semiannually, bonds issued elsewhere often have annual coupon payments. suppose a german company issues a bond with a par value of €1,000, 20 years to maturity, and a coupon rate of 7.8 percent paid annually. if the yield to maturity is 8.9 percent, what is the current price of the bond? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 2

Another question on Business

Business, 22.06.2019 11:00

When the federal reserve buys bonds from or sells bonds to member banks, it is called monetary policy reserve ratio interest rate adjustment open market operations

Answers: 1

Business, 22.06.2019 17:30

Which curve shows increasing opportunity cost as you give up more of one option? demand curve bow-shaped curve yield curve indifference curve

Answers: 3

Business, 22.06.2019 23:40

Elite coffee and bakery, a café that offers a relaxing environment to enjoy quality coffees, teas, soups, and other menu items, has a poster in the front of its restaurants that reads, "we will always provide a quality product to our customers better meet the challenges of their day and always take the time to offer caring service one person at a time." this statement is elite's

Answers: 2

Business, 23.06.2019 00:00

Which of the following statements is true about an atm card?

Answers: 1

You know the right answer?

Even though most corporate bonds in the united states make coupon payments semiannually, bonds issue...

Questions

Business, 07.03.2021 04:10

Health, 07.03.2021 04:10

Mathematics, 07.03.2021 04:10

Mathematics, 07.03.2021 04:10

Mathematics, 07.03.2021 04:10

English, 07.03.2021 04:10

History, 07.03.2021 04:10

Health, 07.03.2021 04:10

Mathematics, 07.03.2021 04:10

Mathematics, 07.03.2021 04:10