Business, 05.11.2019 02:31 makaylahunt

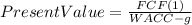

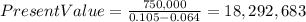

Acompany is expected to have free cash flows of $0.75 million next year. the weighted average cost of capital is wacc = 10.5%, and the expected constant growth rate is g = 6.4%. the company has $2 million in short-term investments, $2 million in debt, and 1 million shares. what is the stock's current intrinsic stock price? a. $17.39b. $17.84c. $18.29d. $18.75e. $19.22

Answers: 2

Another question on Business

Business, 21.06.2019 23:30

San ruiz interiors provides design services to residential and commercial clients. the residential services produce a contribution margin of $450,000 and have traceable fixed operating costs of $480,000. management is studying whether to drop the residential operation. if closed, the fixed operating costs will fall by $370,000 and san ruiz’ income will

Answers: 3

Business, 22.06.2019 11:20

You decided to charge $100 for your new computer game, but people are not buying it. what could you do to encourage people to buy your game?

Answers: 1

Business, 22.06.2019 16:50

Coop inc. owns 40% of chicken inc., both coop and chicken are corporations. chicken pays coop a dividend of $10,000 in the current year. chicken also reports financial accounting earnings of $20,000 for that year. assume coop follows the general rule of accounting for investment in chicken. what is the amount and nature of the book-tax difference to coop associated with the dividend distribution (ignoring the dividends received deduction)?

Answers: 2

You know the right answer?

Acompany is expected to have free cash flows of $0.75 million next year. the weighted average cost o...

Questions

Spanish, 13.05.2021 17:10

English, 13.05.2021 17:10

Mathematics, 13.05.2021 17:10

Mathematics, 13.05.2021 17:10

Spanish, 13.05.2021 17:10

English, 13.05.2021 17:10

Mathematics, 13.05.2021 17:10

Mathematics, 13.05.2021 17:10

Physics, 13.05.2021 17:10

Mathematics, 13.05.2021 17:10