Business, 05.11.2019 04:31 raquelle66

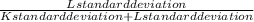

Consider two perfectly negatively correlated risky securities, k and l. k has an expected rate of return of 13% and a standard deviation of 19%. l has an expected rate of return of 10% and a standard deviation of 16%. the risk-free portfolio that can be formed with the two securities will earn rate of return.

Answers: 2

Another question on Business

Business, 21.06.2019 15:00

As part of a hiring process, codex marketing company conducts an internet search to discover what a job candidate has posted. to codex, this act should present

Answers: 2

Business, 22.06.2019 12:10

Which of the following is not part of the mission statement of the department of homeland security? lead the unified national effort to secure america protect against and respond to threats and hazards to the nation ensure safe and secure borders coordinate intelligence operations against terrorists in other countries

Answers: 1

Business, 22.06.2019 21:10

Krier industries has just completed its sales forecasts and its marketing department estimates that the company will sell 43,800 units during the upcoming year. in the past, management has maintained inventories of finished goods at approximately 3 months' sales. however, the estimated inventory at the start of the year of the budget period is only 7,300 units. sales occur evenly throughout the year. what is the estimated production level (units) for the first month of the upcoming budget year?

Answers: 3

You know the right answer?

Consider two perfectly negatively correlated risky securities, k and l. k has an expected rate of re...

Questions

Mathematics, 08.05.2021 23:20

Social Studies, 08.05.2021 23:20

Mathematics, 08.05.2021 23:20

Mathematics, 08.05.2021 23:20

Chemistry, 08.05.2021 23:20

Physics, 08.05.2021 23:20

..................1

..................1