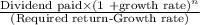

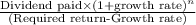

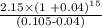

The jackson-timberlake wardrobe co. just paid a dividend of $2.15 per share on its stock. the dividends are expected to grow at a constant rate of 4 percent per year indefinitely. if investors require a return of 10.5 percent on the company’s stock,

(a)-what is the current price?

(b)-what will the price be in three years?

( will the price be 15 years?

Answers: 2

Another question on Business

Business, 21.06.2019 15:10

Pressure systems, inc., manufactures high-accuracy liquid-level transducers. it is investigating whether it should update certain equipment now or wait to do it later. if the cost now is $200,000, what will the equivalent amount be 3 years from now at an interest rate of 10% per year?

Answers: 3

Business, 21.06.2019 23:30

Afinancial institution, the thriftem bank, is in the process of formulating its loan policy for the next quarter. a total of $12 million is allocated for that purpose. being a full-service facility, the bank is obligated to grant loans to different clientele. the following table provides the types of loans, the interest rate charged by the bank, and the possibility of bad debt as estimated from past experience.type of loaninterest rateprobability of bad debtpersonal.140.10car.130.07home.120.03farm.125.05commercial.100.02 bad debts are assumed unrecoverable and hence produce no interest revenue either. competition with other financial institutions in the area requires that the bank allocate at least 40% of the total funds to farm and commercial loans. to assist the housing industry in the region, home loans must equal at least 50% of the personal, car, and home loans. the bank also has a stated policy specifying that the overall ratio for bad debts on all loans may not exceed .04. formulate this problem as a linear program. define your variables clearly and write all the constraints explaining the significance of each.

Answers: 1

Business, 22.06.2019 00:10

What are the forecasted levels of the line of credit and special dividends? (hints: create a column showing the ratios for the current year; then create a new column showing the ratios used in the forecast. also, create a preliminary forecast that doesn’t include any new line of credit or special dividends. identify the financing deficit or surplus in this preliminary forecast and then add a new column that shows the final forecast that includes any new line of credit or special dividend.) now assume that the growth in sales is only 3%. what are the forecasted levels of the line of credit and special dividends?

Answers: 1

Business, 22.06.2019 12:00

Agovernment receives a gift of cash and investments with a fair value of $200,000. the donor specified that the earnings from the gift must be used to beautify city-owned parks and the principal must be re-invested. the $200,000 gift should be accounted for in which of the following funds? a) general fund b) private-purpose trust fund c) agency fund d) permanent fund

Answers: 1

You know the right answer?

The jackson-timberlake wardrobe co. just paid a dividend of $2.15 per share on its stock. the divide...

Questions

Mathematics, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01

Physics, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01

Biology, 20.10.2020 01:01

Health, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01

Social Studies, 20.10.2020 01:01

English, 20.10.2020 01:01