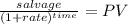

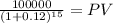

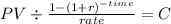

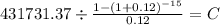

The tree top airline (tta) is a small feeder-freight line started with very limited capital to serve the independent petroleum operators in the arid southwest. all of its planes are identical, although they are painted different colors. tta has been contracting its overhaul work to alamo airmotive for $35,000 per plane per year. tta estimates that, by building a $450,000 maintenance facility with a life of 15 years and a residual (market) value of $100,000 at the end of its life, they could handle their own overhaul at a cost of only $25, 000 per plane per year. what is the minimum number of planes they must operate to make it economically feasible to build this facility? the marr is 12% per year.

Answers: 3

Another question on Business

Business, 22.06.2019 11:30

Given the following information about the closed economy of brittania, what is the level of investment spending and private savings, and what is the budget balance? assume there are no government transfers. gdp=$1180.00 million =$510.00 million =$380.00 million =$280.00 million

Answers: 3

Business, 22.06.2019 16:00

Three pounds of material a are required for each unit produced. the company has a policy of maintaining a stock of material a on hand at the end of each quarter equal to 30% of the next quarter's production needs for material a. a total of 35,000 pounds of material a are on hand to start the year. budgeted purchases of material a for the second quarter would be:

Answers: 1

Business, 22.06.2019 19:40

Best burger is a major fast food chain. its managers are motivated to grow the firm in order to increase their market power and change the industry structure in their favor. which of the following strategies is most associated with their motive for growth? a. employing celebrity spokespeople b. implementing automated burger-making machinery c. purchasing competitors d. increasing executive salaries

Answers: 3

Business, 22.06.2019 20:30

Afirm wants to strengthen its financial position. which of the following actions would increase its current ratio? a. reduce the company's days' sales outstanding to the industry average and use the resulting cash savings to purchase plant and equipment.b. use cash to repurchase some of the company's own stock.c. borrow using short-term debt and use the proceeds to repay debt that has a maturity of more than one year.d. issue new stock, then use some of the proceeds to purchase additional inventory and hold the remainder as cash.e. use cash to increase inventory holdings.

Answers: 3

You know the right answer?

The tree top airline (tta) is a small feeder-freight line started with very limited capital to serve...

Questions

Mathematics, 30.07.2019 20:30

Biology, 30.07.2019 20:30

Social Studies, 30.07.2019 20:30

Mathematics, 30.07.2019 20:30

Mathematics, 30.07.2019 20:30

Mathematics, 30.07.2019 20:30

English, 30.07.2019 20:30

History, 30.07.2019 20:30

Mathematics, 30.07.2019 20:30