Business, 08.11.2019 02:31 artiomtyler007

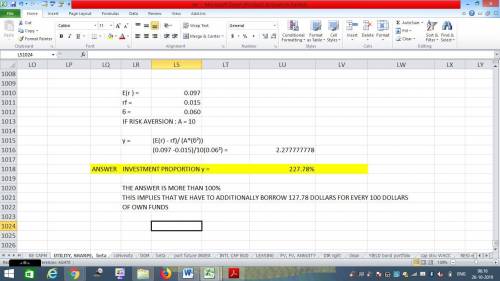

You are constructing a portfolio for an investor with a risk aversion of a=10. you can invest their money in a riskless asset with a return of 0.015, or a risky asset with an expected return of 0.097 and a standard deviation of 0.06. what proportion of their assets should you put in the risky asset? an answer of 0 means none of their assets, an answer of 1 means all of their assets.

Answers: 3

Another question on Business

Business, 22.06.2019 11:20

Lusk corporation produces and sells 14,300 units of product x each month. the selling price of product x is $25 per unit, and variable expenses are $19 per unit. a study has been made concerning whether product x should be discontinued. the study shows that $72,000 of the $102,000 in monthly fixed expenses charged to product x would not be avoidable even if the product was discontinued. if product x is discontinued, the annual financial advantage (disadvantage) for the company of eliminating this product should be:

Answers: 1

Business, 22.06.2019 14:40

You are purchasing a bond that currently sold for $985.63. it has the time-to-maturity of 10 years and a coupon rate of 6%, paid semi-annually. the bond can be called for $1,020 in 3 years. what is the yield to maturity of this bond?

Answers: 2

Business, 22.06.2019 17:50

Variable rate cd’s = $90 treasury bills = $150 discount loans = $20 treasury notes = $100 fixed rate cds = $160 money market deposit accts. = $140 savings deposits = $90 fed funds borrowing = $40 variable rate mortgage loans $140 demand deposits = $40 primary reserves = $50 fixed rate loans = $210 fed funds lending = $50 equity capital = $120 a. develop a balance sheet from the above data. be sure to divide your balance sheet into rate-sensitive assets and liabilities as we did in class and in the examples. b. perform a standard gap analysis and a duration analysis using the above data if you have a 1.15% decrease in interest rates and an average duration of assets of 5.4 years and an average duration of liabilities of 3.8 years. c. indicate if this bank will remain solvent after the valuation changes. if so, indicate the new level of equity capital after the valuation changes. if not, indicate the amount of the shortage in equity capital.

Answers: 3

Business, 22.06.2019 23:30

Which statement best describes the two reactions? abcl, + h2 → 2hci2h + h = he + inreaction a involves a greater change, and reaction b involves a change in element identity.reaction b involves a greater change and a change in element identityreaction a involves a greater change and a change in element identity.reaction b involves a greater change, and reaction a involves a change in element identity.

Answers: 1

You know the right answer?

You are constructing a portfolio for an investor with a risk aversion of a=10. you can invest their...

Questions

Mathematics, 05.03.2021 18:50

Mathematics, 05.03.2021 18:50

Mathematics, 05.03.2021 18:50

Mathematics, 05.03.2021 18:50

Mathematics, 05.03.2021 18:50

Mathematics, 05.03.2021 18:50

Mathematics, 05.03.2021 18:50

History, 05.03.2021 18:50

Mathematics, 05.03.2021 18:50