Business, 08.11.2019 07:31 hardwick744

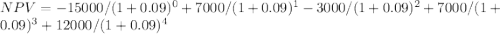

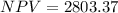

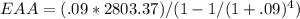

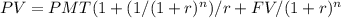

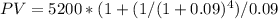

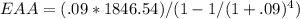

Carlyle inc. is considering two mutually exclusive projects. both require an initial investment of $15,000 at t = 0. project s has an expected life of 2 years with after-tax cash inflows of $7,000 and $12,000 at the end of years 1 and 2, respectively. in addition, project s can be repeated at the end of year 2 with no changes in its cash flows. project l has an expected life of 4 years with after-tax cash inflows of $5,200 at the end of each of the next 4 years. each project has a wacc of 9.00%. what is the equivalent annual annuity of the most profitable project? a. $ 569.97b. $ 782.34c. $ 865.31d. $1,522.18e. $1,846.54

Answers: 1

Another question on Business

Business, 21.06.2019 22:30

Acompany determined that the budgeted cost of producing a product is $30 per unit. on june 1, there were 80,000 units on hand, the sales department budgeted sales of 300,000 units in june, and the company desires to have 120,000 units on hand on june 30. the budgeted cost of goods sold for june would be

Answers: 1

Business, 22.06.2019 04:00

Last week paul, ceo of quality furniture in south carolina, traveled to europe to visit customers. while overseas, paul checked his e-mail daily and showed his company's website to customers, explaining how the website will them place orders and receive merchandise more quickly. after visiting the last customer friday morning, paul was able to return to the corporate office in south carolina to meet with his board of directors that night. is the "shrinking" of time and space with air travel and electronic media.

Answers: 1

Business, 22.06.2019 04:50

Steffi is reviewing various licenses and their uses. match the licenses to their respective uses. you are eligible to work within the state. you are eligible to sell limited investment securities. you are eligible to sell fixed income investment products. your compensation is fee based. section 6 section 7 section 63 section 65

Answers: 3

Business, 22.06.2019 19:30

At december 31, 2016, pina corporation had the following stock outstanding. 10% cumulative preferred stock, $100 par, 107,810 shares $10,781,000 common stock, $5 par, 4,026,000 shares 20,130,000 during 2017, pina did not issue any additional common stock. the following also occurred during 2017. income from continuing operations before taxes $21,950,000 discontinued operations (loss before taxes) $3,505,000 preferred dividends declared $1,078,100 common dividends declared $2,300,000 effective tax rate 35 % compute earnings per share data as it should appear in the 2017 income statement of pina corporation

Answers: 1

You know the right answer?

Carlyle inc. is considering two mutually exclusive projects. both require an initial investment of $...

Questions

History, 20.01.2020 05:31

Mathematics, 20.01.2020 05:31

History, 20.01.2020 05:31

Health, 20.01.2020 05:31

History, 20.01.2020 05:31

Mathematics, 20.01.2020 05:31

Mathematics, 20.01.2020 05:31

English, 20.01.2020 05:31

History, 20.01.2020 05:31

Social Studies, 20.01.2020 05:31