Business, 08.11.2019 07:31 Sfowler5129

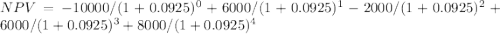

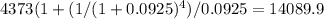

Atlas corp. is considering two mutually exclusive projects. both require an initial investment of $10,000 at t = 0. project s has an expected life of 2 years with after-tax cash inflows of $6,000 and $8,000 at the end of years 1 and 2, respectively. project l has an expected life of 4 years with after-tax cash inflows of $4,373 at the end of each of the next 4 years. each project has a wacc of 9.25%, and project s can be repeated with no changes in its cash flows. the controller prefers project s, but the cfo prefers project l. how much value will the firm gain or lose if project l is selected over project s, i. e., what is the value of npvl - npvs? a. $56.50b. $62.15c. $68.37d. $75.21e. $82.73

Answers: 3

Another question on Business

Business, 21.06.2019 22:30

Acompany determined that the budgeted cost of producing a product is $30 per unit. on june 1, there were 80,000 units on hand, the sales department budgeted sales of 300,000 units in june, and the company desires to have 120,000 units on hand on june 30. the budgeted cost of goods sold for june would be

Answers: 1

Business, 22.06.2019 19:30

Which of the following occupations relate to a skill category of words and literacy

Answers: 1

Business, 22.06.2019 21:00

There is just one person in our group, silvia, who seems to have radically different ideas about how to complete our project. she seems to purposely disagree with the majority opinions of the rest of us though yesterday she said something that made a lot of sense to us solve our production problem. i suggested to the entire group today that we hear silvia’s suggestions and asked silvia to share in-depth more of what she said yesterday. i am using which adaptive leader behavior?

Answers: 2

Business, 22.06.2019 22:30

Rahm's credit card issuer calculates interest based on the outstanding balance at the end of the last billing period. what is this method of calculating interest on a credit card called?

Answers: 2

You know the right answer?

Atlas corp. is considering two mutually exclusive projects. both require an initial investment of $1...

Questions

Biology, 27.08.2019 05:30

Mathematics, 27.08.2019 05:30

Mathematics, 27.08.2019 05:30

Mathematics, 27.08.2019 05:30

Mathematics, 27.08.2019 05:30

History, 27.08.2019 05:30