Business, 10.11.2019 01:31 live4dramaoy0yf9

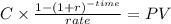

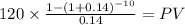

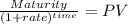

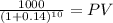

Two years ago, trans-atlantic airlines sold a $250 million bond issue to finance the purchase of new jet airliners. these bonds were issued in $1000 denominations with an original maturity of 12 years and a coupon rate of 12%. determine the value today of one of these bonds to an investor who requires a 14% rate of return on these securities.

Answers: 2

Another question on Business

Business, 22.06.2019 05:20

Carmen co. can further process product j to produce product d. product j is currently selling for $20 per pound and costs $15.75 per pound to produce. product d would sell for $38 per pound and would require an additional cost of $8.55 per pound to produce. what is the differential revenue of producing product d?

Answers: 2

Business, 22.06.2019 11:00

If the guide wprds on the page are "crochet " and "crossbones", which words would not be on the page. criticize, crocodile,croquet,crouch,crocus.

Answers: 1

Business, 22.06.2019 11:00

What is the correct percentage of texas teachers charged with ethics violations each year?

Answers: 2

Business, 22.06.2019 21:10

Upon completion of the northwest-corner rule, which source-destination cell is guaranteed to be occupied? a. top-leftb. the cell with the lowest shipping costc. bottom-leftd. top-righte. bottom-right

Answers: 1

You know the right answer?

Two years ago, trans-atlantic airlines sold a $250 million bond issue to finance the purchase of new...

Questions

English, 05.11.2020 04:40

Biology, 05.11.2020 04:40

Mathematics, 05.11.2020 04:40

Biology, 05.11.2020 04:40

Chemistry, 05.11.2020 04:40

Arts, 05.11.2020 04:40

Mathematics, 05.11.2020 04:40

Mathematics, 05.11.2020 04:40

English, 05.11.2020 04:40

History, 05.11.2020 04:40

Health, 05.11.2020 04:40

Spanish, 05.11.2020 04:40

English, 05.11.2020 04:40