Business, 10.11.2019 03:31 brittany7436

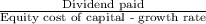

Laurel enterprises expects earnings next year of $4.06 per share and has a 40 % retention rate, which it plans to keep constant. its equity cost of capital is 9 %, which is also its expected return on new investment. its earnings are expected to grow forever at a rate of 3.6 % per year. if its next dividend is due in one year, what do you estimate the firm's current stock price to be?

Answers: 3

Another question on Business

Business, 22.06.2019 01:20

What cylinder head operation is the technician performing in this figure?

Answers: 1

Business, 22.06.2019 10:10

At the end of year 2, retained earnings for the baker company was $3,550. revenue earned by the company in year 2 was $3,800, expenses paid during the period were $2,000, and dividends paid during the period were $1,400. based on this information alone, retained earnings at the beginning of year 2 was:

Answers: 1

Business, 22.06.2019 13:40

After much consideration, you have chosen cancun over ft. lauderdale as your spring break destination this year. however, spring break is still months away, and you may reverse this decision. which of the following events would prompt you to reverse this decision? a. the marginal cost of going to cancun decreases.b. the marginal cost of going to ft. lauderdale decreases.c. the marginal benefit of going to cancun increases.d. the marginal benefit of going to ft. lauderdale decreases.

Answers: 2

Business, 22.06.2019 20:00

What part of the rational model of decision-making does the former business executive “elliott” have a problem completing?

Answers: 2

You know the right answer?

Laurel enterprises expects earnings next year of $4.06 per share and has a 40 % retention rate, whic...

Questions

Mathematics, 15.12.2021 04:10

Mathematics, 15.12.2021 04:10

English, 15.12.2021 04:10

Social Studies, 15.12.2021 04:10

Mathematics, 15.12.2021 04:10

Mathematics, 15.12.2021 04:10

Mathematics, 15.12.2021 04:10

Physics, 15.12.2021 04:10

Business, 15.12.2021 04:10

Mathematics, 15.12.2021 04:10