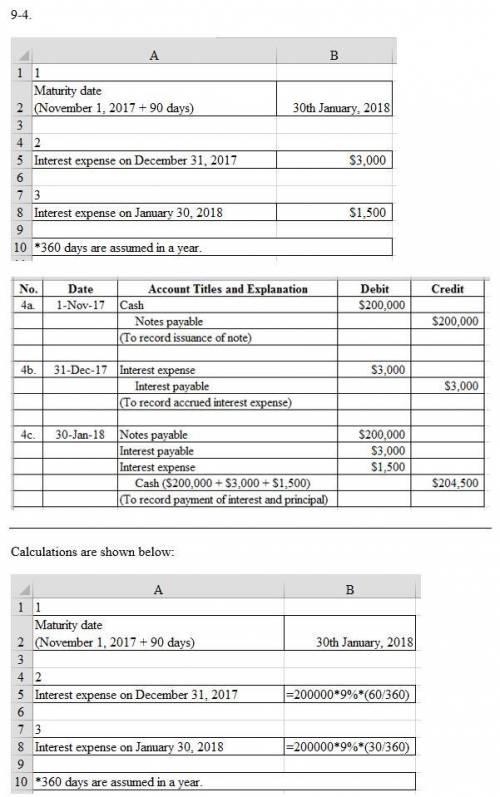

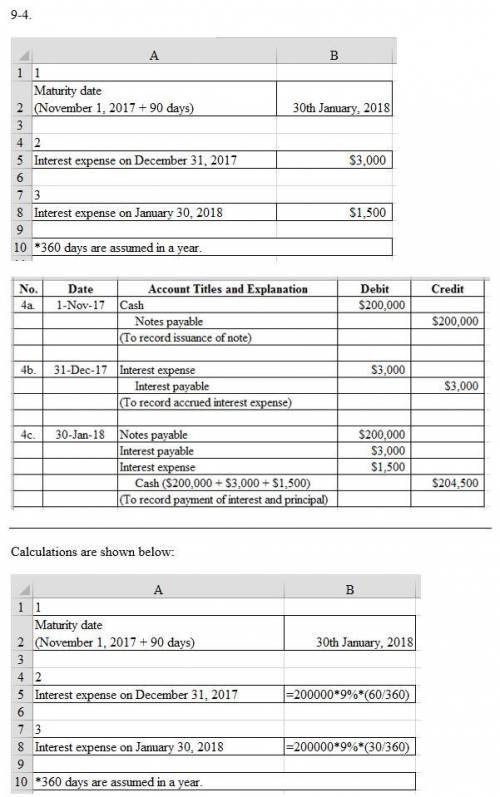

Keesha co. borrows $200,000 cash on november 1, 2017, by signing a 90-day, 9% note with a face value of $200,000. 1. on what date does this note mature? what is the amount of interest expense recorded on 2) december 31, 2017 and 3) january 30, 2018? (use 360 days in the year.) 4 (a) prepare the journal entry to record the issuance of the note on november 1, 2017 4 (b) prepare the journal entry to record the accrual of interest at the end of 2017. 4 (c) prepare the journal entry to record payment of the note at maturity. (assume no reversing entries) exercise 9-10 hitzu co. sold a copier costing $4,800 with a two-year parts warranty to a customer on august 16, 2017 for $6,000 cash. hitzu uses the perpetual inventory system. on november 22, 2018, the copier requires on-site repairs that are completed the same day. the repairs cost $209 for materials taken from the repair parts inventory. these are the only repairs required in 2018 for this copier. based on experience, hitzu expects to incur warranty costs equal to 4% of dollar sales. it records warranty expense with an adjusting entry at the end of each year. 1. how much warranty expense does the company report in 2017 for this copier? 2. how much is the estimated warranty liability for this copier as of december 31, 20177 3. how much warranty expense does the company report in 2018 for this copier? 4. how much is the estimated warranty liability for this copier as of december 31, 2018?

Answers: 1

Another question on Business

Business, 21.06.2019 21:30

Gary becker's controversial the economics of discrimination concludes that price discrimination has no effect on final profits. price discrimination benefits monopolies. labor discrimination in hiring results in more efficient allocations of production. discrimination in hiring practices has no effect on final profits. labor discrimination harms firms that practice it due to increased labor costs. price discrimination harms monopolies, which refutes over two centuries of economic theory.

Answers: 3

Business, 22.06.2019 04:00

Medtronic, inc., is a medical technology company that competes for customers with st. jude medical s.c., inc. james hughes worked for medtronic as a sales manager. his contract prohibited him from working for a competitor for one year after leaving medtronic. hughes sought a position as a sales director for st. jude. st. jude told hughes that his contract with medtronic was unenforceable and offered him a job. hughes accepted. medtronic filed a suit, alleging wrongful interference. which type of interference was most likely the basis for this suit? did it occur here? medtronic, inc., is a medical technology company that competes for customers with st. jude medical s.c., inc. james hughes worked for medtronic as a sales manager. his contract prohibited him from working for a competitor for one year after leaving medtronic

Answers: 2

Business, 22.06.2019 12:20

Over the past decade, brands that were once available only to the wealthy have created more affordable product extensions, giving a far broader range of consumers a taste of the good life. jaguar, for instance, launched its x-type sedan, which starts at $30,000 and is meant for the "almost rich" consumer who aspires to live in luxury. by marketing to people who desire a luxurious lifestyle, jaguar is using:

Answers: 3

Business, 22.06.2019 15:00

Portia grant is an employee who is paid monthly. for the month of january of the current year, she earned a total of $8,388. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year and the fica tax rate for medicare is 1.45% of all earnings. the futa tax rate of 0.6% and the suta tax rate of 5.4% are applied to the first $7,000 of an employee's pay. the amount of federal income tax withheld from her earnings was $1,391.77. what is the total amount of taxes withheld from the portia's earnings?

Answers: 2

You know the right answer?

Keesha co. borrows $200,000 cash on november 1, 2017, by signing a 90-day, 9% note with a face value...

Questions

Mathematics, 05.05.2020 09:49

Business, 05.05.2020 09:49

Computers and Technology, 05.05.2020 09:50

English, 05.05.2020 09:50

History, 05.05.2020 09:50

English, 05.05.2020 09:50

Mathematics, 05.05.2020 09:50

English, 05.05.2020 09:50

Mathematics, 05.05.2020 09:50