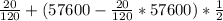

The partnership contract for hanes and jones llp provides that hanes is to receive a bonus of 20% of net income (after the bonus) and that the remaining net income is to be divided equally. if the partnership income before the bonus for the year is $57,600, hanes’ share of this pre-bonus income is:

a. $28,800.

b. $33,600.

c. $34,560.

d. $35,520.

e. $38,40

Answers: 2

Another question on Business

Business, 21.06.2019 16:00

When earning simple interest on money you invest, which statement is true? a. as time goes on and your bank account grows, you earn more interest. b. as time goes on and your bank account grows, you earn less interest. c. as time goes on and your bank account grows, you earn the same amount of interest. d. as time goes on and your bank account grows, you stop earning interest.

Answers: 2

Business, 21.06.2019 22:20

Why should you not sign the tenant landlord agreement quickly and immediately

Answers: 1

Business, 22.06.2019 12:30

Amap from a trade development commission or chamber of commerce can be more useful than google maps for identifying

Answers: 1

Business, 22.06.2019 14:20

Your uncle borrows $53,000 from the bank at 11 percent interest over the nine-year life of the loan. use appendix d for an approximate answer but calculate your final answer using the formula and financial calculator methods. what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest

Answers: 1

You know the right answer?

The partnership contract for hanes and jones llp provides that hanes is to receive a bonus of 20% of...

Questions

Mathematics, 09.06.2021 17:50

History, 09.06.2021 17:50

Spanish, 09.06.2021 17:50

Mathematics, 09.06.2021 17:50

Mathematics, 09.06.2021 17:50

Mathematics, 09.06.2021 17:50

Spanish, 09.06.2021 17:50

English, 09.06.2021 17:50

Mathematics, 09.06.2021 17:50

Chemistry, 09.06.2021 17:50

Biology, 09.06.2021 17:50

English, 09.06.2021 17:50