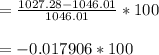

A13-year, 6 percent coupon bond pays interest semiannually. the bond has a face value of $1,000. what is the percentage change in the price of this bond if the market yield to maturity rises to 5.7 percent from the current rate of 5.5 percent? select one:

a. 1.79 percent

b. −1.79 percent

c. −1.38 percent

d. −1.64 percent

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Goods and services that can be used for the same purpose are and goods and services that are used together are

Answers: 1

Business, 22.06.2019 04:30

Annuity payments are assumed to come at the end of each payment period (termed an ordinary annuity). however, an exception occurs when the annuity payments come at the beginning of each period (termed an annuity due). what is the future value of a 13-year annuity of $2,800 per period where payments come at the beginning of each period? the interest rate is 9 percent. use appendix c for an approximate answer, but calculate your final answer using the formula and financial calculator methods. to find the future value of an annuity due when using the appendix tables, add 1 to n and subtract 1 from the tabular value. for example, to find the future value of a $100 payment at the beginning of each period for five periods at 10 percent, go to appendix c for n = 6 and i = 10 percent. look up the value of 7.716 and subtract 1 from it for an answer of 6.716 or $671.60 ($100 × 6.716)

Answers: 2

Business, 22.06.2019 14:00

Your dormitory, griffingate, has appointed you central banker of its economy, which deals in the currency of wizcoins. assume that the velocity of wizcoins in griffingate is constant at 10,000 transactions per year. right now, real gdp is 1,000 wizcoins, and there are 2,000 wizcoins in existence.

Answers: 2

You know the right answer?

A13-year, 6 percent coupon bond pays interest semiannually. the bond has a face value of $1,000. wha...

Questions

English, 22.06.2019 02:00

Mathematics, 22.06.2019 02:00

Advanced Placement (AP), 22.06.2019 02:00

English, 22.06.2019 02:00

Mathematics, 22.06.2019 02:00