Business, 16.11.2019 01:31 jessieeverett432

Globe inc. is a distributor of dvds. dvd mart is a local retail outlet which sells blank and recorded dvds. dvd mart purchases tapes from globe at $25.00 per dvd; dvds are shipped in packages of 60. globe pays all incoming freight, and dvd mart does not inspect the dvds due to globe's reputation for high quality. annual demand is 312,000 dvds at a rate of 6,000 dvds per week. dvd mart earns 15% on its cash investments. the purchase-order lead time is one week. the following cost data are available:

relevant ordering costs per purchase order $114.50

carrying costs per package per year:

relevant insurance, materials handling,

breakage, etc., per year $ 4.50

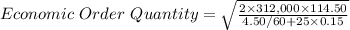

11) what is the economic order quantity?

a) 64.08 packages

b) 21.04 packages

c) 37.50 packages

d) 72.03 packages

Answers: 3

Another question on Business

Business, 20.06.2019 18:02

The number of people in the united states who overdose on heroin is greater than the number who overdose on any other type of opioid, including hydrocodone, oxycodone, and methadone

Answers: 2

Business, 21.06.2019 20:20

Atoy manufacturer makes its own wind-up motors, which are then put into its toys. while the toy manufacturing process is continuous, the motors are intermittent flow. data on the manufacture of the motors appears below.annual demand (d) = 50,000 units daily subassembly production rate = 1,000setup cost (s) = $85 per batch daily subassembly usage rate = 200carrying cost = $.20 per unit per year(a) to minimize cost, how large should each batch of subassemblies be? (b) approximately how many days are required to produce a batch? (c) how long is a complete cycle? (d) what is the average inventory for this problem? (e) what is the total annual inventory cost (holding plus setup) of the optimal behavior in this problem?

Answers: 2

Business, 22.06.2019 08:40

Calculate the cost of each capital component—in other words, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). use both the capm method and the dividend growth approach to find the cost of equity.calculate the cost of new stock using the dividend growth approach.what is the cost of new common stock based on the capm? (hint: find the difference between re and rs as determined by the dividend growth approach and then add that difference to the capm value for rs.)assuming that gao will not issue new equity and will continue to use the same target capital structure, what is the company’s wacc? e. suppose gao is evaluating three projects with the following characteristics.each project has a cost of $1 million. they will all be financed using the target mix of long-term debt, preferred stock, and common equity. the cost of the common equity for each project should be based on the beta estimated for the project. all equity will come from reinvested earnings.equity invested in project a would have a beta of 0.5 and an expected return of 9.0%.equity invested in project b would have a beta of 1.0 and an expected return of 10.0%.equity invested in project c would have a beta of 2.0 and an expected return of 11.0%.analyze the company’s situation, and explain why each project should be accepted or rejected g

Answers: 1

Business, 22.06.2019 14:40

Which of the following statements about revision is most accurate? (a) you must compose first drafts quickly (sprint writing) and return later for editing. (b) careful writers always revise as they write. (c) revision is required for only long and complex business documents. (d) some business writers prefer to compose first drafts quickly and revise later; others prefer to revise as they go.

Answers: 3

You know the right answer?

Globe inc. is a distributor of dvds. dvd mart is a local retail outlet which sells blank and recorde...

Questions

Mathematics, 12.03.2020 21:52

Mathematics, 12.03.2020 21:52

Computers and Technology, 12.03.2020 21:52

English, 12.03.2020 21:52

History, 12.03.2020 21:52

SAT, 12.03.2020 21:53

Mathematics, 12.03.2020 21:53

Business, 12.03.2020 21:53